kentoh/iStock via Getty Images

I last covered Tesla, Inc. (NASDAQ:TSLA) in May; I put out a Buy rating at the time, and since then, the stock has gained approximately 40% in price. The stock has about broken even since my first thesis in November 2023, and I have allocated Buy ratings throughout my entire analyst rating history on the company thus far.

This time around, I am reiterating my Buy rating once more because I view Tesla as a sustainable long-term investment that is hinged on the long-term value and moat. I believe Tesla is going to develop in AI, robotics and autonomous driving. In my opinion, the last 18 months have had multiple significant long-term buying opportunities. What is being undervalued by the market significantly is the sentiment and goodwill attributed to Tesla stock, which can largely only be maintained through Tesla’s continued growth in autonomous taxis moving forward. Otherwise, its fundamental growth is highly unlikely to sustain the current valuation.

Now, notably, Tesla’s autonomous taxi plans are beginning to become more concrete, and the 40% rally since my last analysis represents an inflection point in the market sentiment on Tesla stock, in my opinion. Moving forward, I expect some volatility to remain, but over the next 5 years, I think the stock could grow by a 5-year CAGR of approximately 35% to a 2029 price of approximately $1,045, based on my bull-case scenario analysis.

Autonomous Revolution: Robotaxis

I think it is valid to state that Tesla is on course to transform transportation forever if it successfully executes its autonomous taxi strategy at scale. If Tesla achieves this, it will be absolutely miles ahead of competitors, and it is likely to be able to consolidate a significant moat in the field. In my opinion, I believe Musk is likely to partner with other ride-hailing apps like Uber (UBER), and potentially license out its full self-driving (“FSD”) technology to third-party automakers.

In essence, I see the long-term future for TSLA as being the Nvidia (NVDA) of advanced transportation. My view is that this is going to help the company to drastically increase margins, and as a result of such increases it will command much higher free cash flow over the long term as a result of its moat. This free cash flow allows it to continue to expand its infrastructure, and also open up the possibility of share buybacks at scale to further reward investors.

Tesla’s intention to build a robotaxi service marks a shift from private car ownership to mobility-as-a-service (“MaaS”). In my opinion, Musk’s vision for Tesla in autonomous taxis is very liberating for the people—McKinsey’s analysis suggests that the total cost of transport may decline by 30% to 50% compared to private vehicles and by about 70% compared to traditional ride-hailing services.

I believe Tesla is a case study of the astronomical economic benefits made possible by the autonomous revolution. Tesla is likely to be the company that most powerfully transforms the economic order for transportation and makes private transport accessible to a whole class of consumers who before could only afford public transport. This is a radical evolution, and the economic benefits accrue not only to Musk and Tesla’s shareholders but also to the Western alliance as Tesla is reinforced as one of the largest AI moats in the world. I believe Tesla has the capability to help strengthen the economic order in the West by driving deflation in the transportation and energy sectors. If it partners with other Western and Chinese companies, it can act as a significant linchpin in the global AI-led world order.

I am very hopeful about Tesla’s long-term future as a result of CEO Elon Musk’s recent statements on the company. My feeling is that this strategy potentially marks an inflection point for Musk, both in operational strategy and in leadership sentiment. My feeling from reading and watching his statements as of late is that he will potentially be more collaborative and, it is my hope, less ruthless moving forward to help support lasting positive sentiment in both domestic and international markets.

While there are valid concerns about near-term regulatory constraints, as well as the earlier approval of competitors such as Waymo, I reiterate that Tesla should not be underestimated. Tesla benefits from 4M Teslas globally, feeding data back to the company. As a result, it can refine its AI models more effectively than competitors, as its dataset is much larger. In addition, Tesla employs a technique called imitation learning, where its AI learns from the decisions and behaviors of human drivers. This AI-centric approach to FSD sets Tesla apart because other companies do not use the same end-to-end neural network design. It integrates perception, planning, and control, allowing for a more seamless and efficient driving experience, and I believe, over the long term, will also be safer. Again, I stress that the highest growth is likely to accrue to Tesla if it seeks AI partnerships and develops networks with other companies to support its AI-centric approach to transportation. I think collaboration in the field of AI is likely to develop some of the most profound, safe, and innovative capabilities we have ever seen in history.

In the near term, the delay of the robotaxi unveiling to October has caused some momentarily lowered sentiment in the market surrounding TSLA stock, but I do not think it is wrong for Musk to take his time with this. First impressions count, and while what the market thinks in the short term might not matter over the long term, it is certainly easier not to have to deal with unwarranted negative sentiment. Tesla fans can expect no steering wheel or pedals in the robotaxi design, and Musk has mentioned the delay was partly due to a significant design change to the front of the vehicle. Of course, the robotaxi will feature Tesla’s latest FSD technology—the most important and vital element of the nascent offering.

Ambitious timelines are, of course, Musk’s style, and it arguably helps him to push forward faster. Any price volatility from momentary delays can arguably open up long-term buying opportunities. In my opinion, it is the custom hardware (the FSD chip) with advanced AI software that is really going to make the vehicles shine.

Financial & Valuation Analysis

Most analysts are still expecting a YoY decline for Q2 2024, but I think the market is less concerned with the near-term earnings results now a longer-term road map is being outlined for autonomous taxi growth. The macro environment is also still tight, and I expect this to ease over the next year or so. In my opinion, Tesla’s autonomous taxi network may begin to gain real-world traction alongside broader macroeconomic growth. In other words, Q2 marks the halfway point of a very tough year for Tesla, and I think the market is already beginning to price in the favorable outlook many analysts have for the company’s growth in fiscal 2025 and beyond.

Tesla reported its lowest gross profit margin in over six years in Q1 2024 as the EV market has become increasingly competitive and saturated. To stay competitive, Musk has had to cut prices and offer programs like zero-interest loans in China. Now that the company is pivoting to a robotaxi operating model, the long-term financials are going to change significantly, and Tesla will again find itself in a league of its own for quite some time. Musk is very clever in this regard, and I think he tries to follow the marketing adage “be the only, not just the best.”

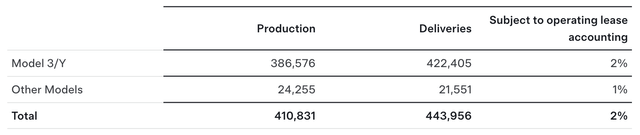

Despite this year’s challenges, Tesla has reported total deliveries for Q2 of 443,956 and “deployed 9.4 GWh of energy storage products in Q2, the highest quarterly deployment yet”:

I am very bullish about TSLA moving forward, but I am not as bullish as ARK Invest, who predicts a $2,600 price target for TSLA by 2029. The current stock price is approximately $254. In my opinion, 5 years is not enough time for the robotaxi initiative to be integrated at scale, although I think by this point, Tesla would have rolled out various robotaxi operations in regions where it has gained regulatory approval.

It is not inconceivable that in 5 years, the firm’s gross margin has expanded to 25% as a result of new initiatives. The reason I believe this cannot be higher is that there are likely to be many development costs in the near term, including potential fleet development, extensive software updates, and network development. I think that the full robotaxi initiative by Tesla could take up to 10 years from now to be fully operational at scale. At that point, a gross margin of 30% to 35% may be tenable. This is due to economies of scale, network effects, licensing of FSD technology to third-parties, and utilizing pre-existing customer cars for robotaxi journeys at scale, among other catalysts related to autonomous transport. The result of this could be a net margin for Tesla as high as 20% in 10 years or 16.5% in 5 years.

Tesla may also find itself a beneficiary of further tax incentives related to renewable energy moving forward. Its autonomous taxi network could significantly reduce the amount of fossil fuel cars on the road through the provision of significantly cheaper electric private transportation; this is another notable catalyst which could contribute to its future net margin expansion. Furthermore, I do not see it unlikely that the United States government will introduce AI funding acts to support the deflationary effects of autonomous technologies, of which I believe Musk’s Tesla could be a significant beneficiary.

If the company achieves a 30% CAGR in normalized EPS from December 2024 until December 2029, it will have normalized EPS of $9.50 in December 2029, as the current normalized basic EPS estimate is $2.56 for December 2024. As a result of this high growth that is likely to be significantly related to robotaxis, I believe the company’s valuation multiples will expand. I think by December 2029, the TTM non-GAAP PE ratio may have expanded to 110. I think this is conceivable because TSLA is not valued based on fundamentals; it is typically valued on a growth story, whereby the fundamentals act as the foundation for such a story.

Once the long-term narrative surrounding autonomous taxis begins to scale, the sentiment in the market will regain tremendous positivity. The speculative nature of this valuation is why I keep TSLA in my portfolio at no more than 5% to 7.5%. I believe any higher is slightly too risk-on over a long time horizon and opens up a significant possibility for high and unexpected periods of volatility. If my forecast comes true, the stock price may be worth approximately $1,045 in December 2029. This is my bull-case prediction, and it indicates a stock price CAGR of 34.7% if the stock is worth $230.50 in December 2024 (PE of 90 X EPS estimate of $2.56).

Risk Analysis

My optimistic prediction outlined above could be significantly hampered by regulatory constraints, and additionally, the initial development and implementation of Tesla’s autonomous taxi network could take longer than 5 years. I believe there is a possibility of constraints and challenges, meaning a lower level of margin expansion and, hence, a growth rate in normalized EPS of circa 25% over the period instead of 30%.

In addition, there is also the possibility of sentiment in the market not expanding as radically as it has previously, especially if bad press develops surrounding the safety of autonomous taxis. While I am hopeful and remain a shareholder of Tesla, I think there could be catalysts for downward sentiment in the market. As a result, even if growth is maintained, the market may decide the valuation for Tesla is no longer sustainable and lose interest in the growth story. It is so much more richly valued against the fundamentals than other auto and big tech companies.

As a result, the P/E ratio could conceivably contract down instead of up, for example, to 80 by December 2029. The result of this would be normalized EPS of $7.81 in December 2029 and a stock price of $624.80. This implies a 5-year CAGR of 10.74% from December 2024 to December 2029, which I would not consider market-beating.

This is my bear-case prediction, and both of my price targets here are hypothetical, but I think that an allocation to Tesla is wise because, in a worst-case scenario, I think it delivers market-level returns with higher volatility. In a best-case scenario, I think it significantly outperforms the market over 5+ years. In my opinion, the valuation is critical to monitor. I think that if TSLA reaches a P/E ratio of 125+ during the timeframe, selling is warranted.

Factors that could contribute to my bear-case price target coming to fruition include severe regulatory delays regarding the permits required to operate autonomous taxis. There is, therefore, significant uncertainty about a timeline for the robotaxis being released. As an example of delays that can occur, Waymo faced a 120-day suspension of its application to expand robotaxi operations in California due to additional scrutiny—if Tesla does not engage proactively with regulators, it could face similar or longer delays. These delays and the demands placed on Tesla to meet requirements also have a likelihood of increasing costs in the near term. This is why I think it is not improbable that the company faces short-term volatility in stock price while it stabilizes its autonomous taxi operations.

I think what is key to Tesla’s success moving forward is the perception regulators hold of Tesla and also of Musk’s stewardship, as well as the perception that the public holds. Musk has been outspoken that he does not cow to the interests of the public, instead favoring his vision and the objective of the mission. However, with operations as sensitive and potentially dangerous as autonomous transport, Tesla is likely to experience higher levels of scrutiny.

I think such scrutiny is valid. As Tesla ventures into full autonomy, a measured, responsible, collaborative, and mature approach from Musk is vital to be able to execute this plan with full service to Tesla customers, fans, and industry partners. I also firmly believe that if Tesla adopts a heightened collaborative approach in this new operational strategy, it will significantly bolster Musk’s influence positively, rather than an isolationist and competitive approach. The latter, I believe, could deter regulators and create a negative perception in the press, potentially driving away a large market of customers.

Conclusion

In my opinion, the next bull run for TSLA has barely even started. The 40% rally since my last thesis indicates a signal of the sentiment that is likely to be built once the autonomous taxi project fully begins to operate. Musk is now 53 years old, and he is planning to radically transform the operating model of the main company that made him famous and wealthy. I view the autonomous taxi chapter of Tesla’s operational strategy as phase 2 for both Musk’s life and the life of Tesla.

I think the strategy is far ahead of the curve. It could be able to offer the cheapest private high-standard transportation in history. As a result of this narrative, TSLA is a long-term Buy, as even in my bear-case scenario analysis, the stock is likely to appreciate in line with the broader market. In my bull-case outcome, I think the stock could be worth $1,045 by December 2029.