baileystock

Investment Thesis:

After the recent Tesla, Inc. (NASDAQ:TSLA) rally, I believe the stock has reached levels that represent a significant overvaluation, which leads me to issue a strong-sell rating. I believe there is little justification for buying or even holding this equity. Tesla stock is a strong sell for many reasons, the primary one being that the current valuation can only be supported as a result of speculative growth prospects such as robotaxis and extreme growth in their software and energy segments.

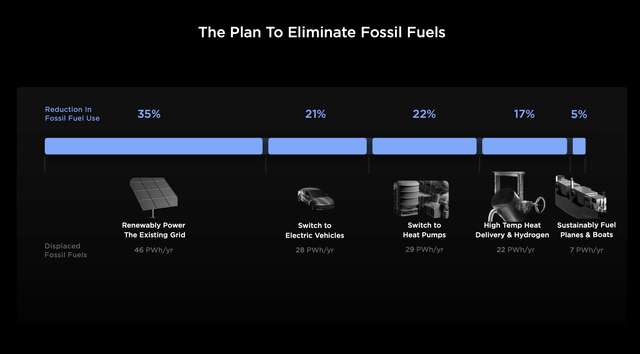

Tesla Energy Plans (TSLA investor relations)

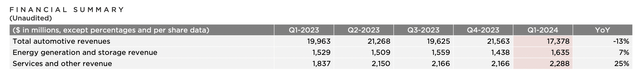

The factors above, compounded with competition driving down margins, tariffs on EVs imported from China virtually harming Tesla’s Chinese factories, and a CEO running other major companies, creates a scenario where Tesla faces challenges over the near and long term. The fact that Tesla’s business faces genuine growth challenges over the coming years makes the stock appear tremendously overvalued when valuing it as a regular business, and even more so when comparing it to its automotive peers (Tesla trades at 8x TTM Revenue and 72x P/FCF vs. 0.92 P/S and 9x P/FCF which are the sector medians). And yes, Tesla is a car company. The majority of Tesla’s revenues come from cars, and they have the margins of a car company.

Tesla revenue breakdown (Tesla q1 shareholder deck)

Plenty of people justify Tesla’s absurd valuation by saying it is a software company. First, no it is not, and even if it was, it would still be difficult to justify its valuation. Overall, the probability of Tesla achieving its monstrous growth prospects is relatively low, yet, the stock has priced in tremendous growth over the long term.

Large Multiples and Lacking Margins:

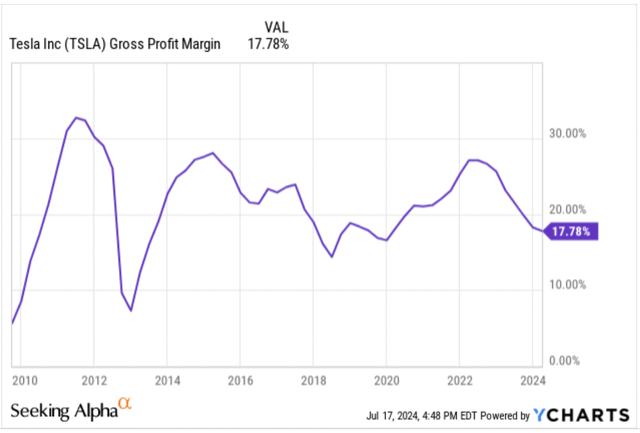

To begin painting the picture of why I believe Tesla is overvalued, I want to further dive into Tesla’s multiples in terms of their revenues and cash flows, as well as their margins relative to their competitors. If Tesla were to command a higher multiple than its peers, it should have larger growth prospects, a durable competitive advantage, and industry-leading margins. First, in terms of Tesla’s margins, they currently have a 17.78% gross margin in the TTM, which has regressed from a peak of 25.28% in 2021.

Tesla gross margin (Y-Charts / Seeking Alpha)

The regression in Tesla’s gross margins tells me that the company has begun to lose its pricing power in the EV sector as competitors have begun to flood in, ultimately leading to price reductions on Tesla’s side. These margin pressures are likely to continue as the legacy automakers and new EV businesses continue releasing new product lines that compete with Tesla in the form of fully electric vehicles or hybrids. EVs are typically pricier than hybrids, and considering that automobiles are essentially the largest discretionary purchase that consumers make, Tesla’s ability to compete on price with their competitors is crucial.

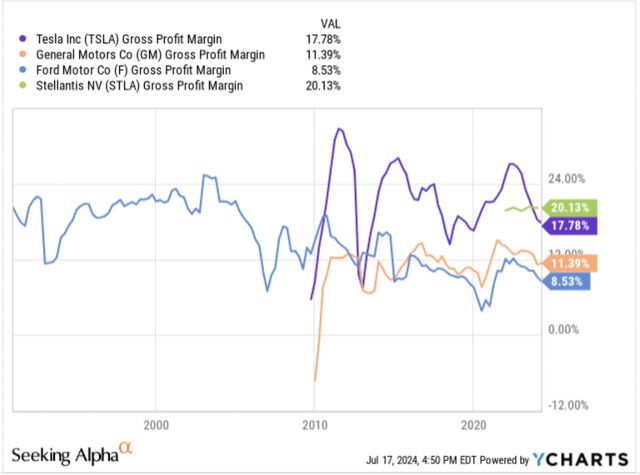

Speaking of their competitors, I will primarily compare Tesla’s metrics with the big three legacy automakers of Ford (NYSE:F), General Motors (NYSE:GM) and Stellantis (NYSE:STLA). Ford, GM, and Stellantis maintain 8.6%, 11.47%, and 20.15% gross margins respectively. Although Ford and GM’s gross margins are significantly below Tesla, Stellantis maintains margins higher than Tesla.

Tesla Gross Margin vs. Peers (Y Charts / Seeking Alpha)

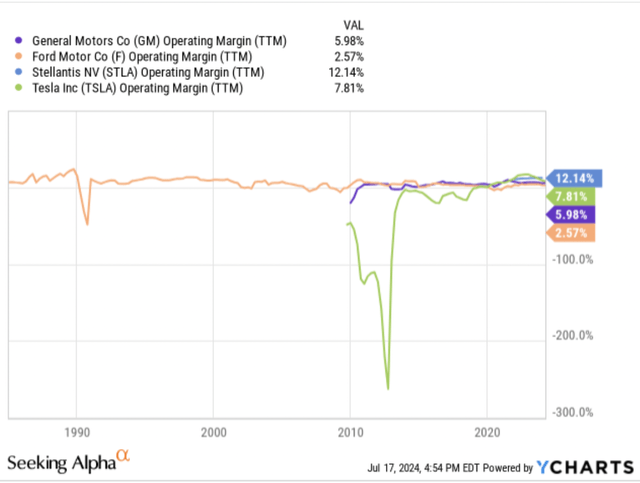

Typically, people will point to Tesla’s higher gross margins relative to Ford and GM to boast about how their software segment is contributing to leading margins, yet Stellantis does not have a developed software component of their business. To me, Tesla’s margins look like they’re in the middle of the pack and nothing that warrants a premium for their business. Their operating margins tell a similar story as Tesla has a 7.81% operating margin compared to 2.67%, 6.14%, and 12.12% operating margins for Ford, GM, and Stellantis, respectively.

Tesla Operating Margin vs. peers (Y Charts / Seeking Alpha)

Moving on to their multiples, Tesla trades at 105x TTM operating income. Now, it is important to note that multiples don’t necessarily mean anything. Tesla could absolutely justify their sky-high multiple if they have considerable growth prospects and a phenomenal business, yet this is not the case.

Tesla’s multiple becomes even more absurd when compared to their peers. Typically, over long periods of time, businesses trade at roughly 15x earnings. However, many of the legacy automakers trade at significantly lower multiples due to the capital intensive and hyper-competitive nature of their businesses. For instance, Ford, GM, and Stellantis trade at 12.169, 5.28, and 2.4x operating income respectively. Although Tesla evidently has better growth prospects and technology, it does not justify such an extreme gap between them and their competitors in terms of valuation.

Capital Intensity and Competition:

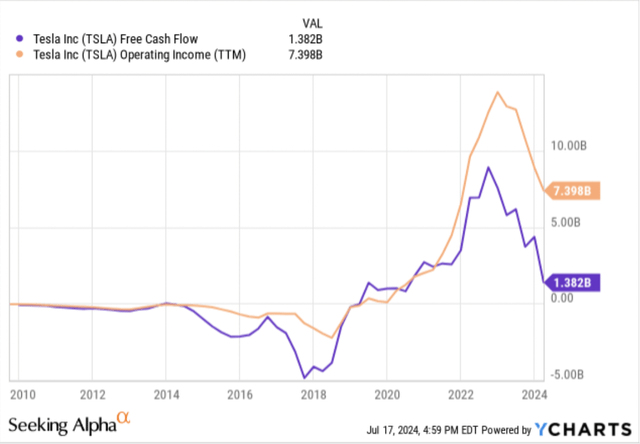

The automotive industry has been historically difficult to operate in and Tesla is not immune to it. For Tesla to continue expanding their operations, they need to build additional factories. These factories require extremely high capital expenditures, which hinder their cash flows. For instance, Tesla had just $1 billion in free cash flow in the TTM compared to $7 billion in operating income.

Tesla FCF v. Operating Income (Y Charts / Seeking Alpha)

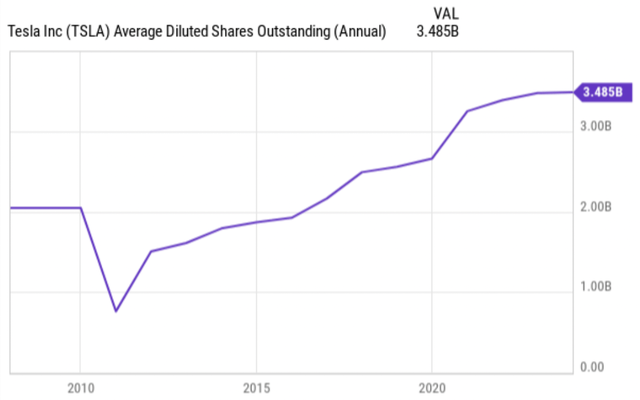

At the end of the day, free cash flow is the life-blood of the business, and Tesla has had and will continue to have high capital expenditures for a sustained period of time. Tesla’s low free cash flow will harm their ability to adequately return capital to shareholders in the future and re-invest in the business without dipping into their cash reserves. This has also caused Tesla’s shares outstanding to continue increasing, therefore diluting existing shareholders as they have limited capital to buyback shares.

Tesla shares outstanding (Y Charts / Seeking Alpha)

Furthermore, EVs present an additional challenge as the charging infrastructure has to be properly built out before it is feasible for consumers to purchase an EV. I will elaborate more later, but building out charging infrastructure is not only capital intensive and takes a lot of time. It also heavily limits Tesla’s ability to sell EVs in certain areas, such as internationally and in rural areas. The need for charging infrastructure raises the question about whether Tesla is already approaching their peak in terms of the number of vehicles they can sell.

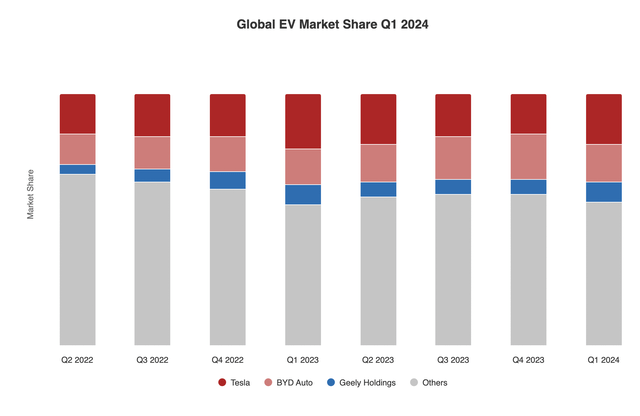

The problem for Tesla is compounded when considering that competition is increasing among other automakers while they are competing for limited space. Although the overall EV market is growing, the entrance of many new competitors raises many challenges for Tesla. Every legacy automaker from Ford to Volkswagen as well as new entrants to the industry such as Rivian (RIVN) and Lucid (LCID) present major competitive hurdles for Tesla. Increased competition presents the threat of continued price cuts and consumers shopping around different places for their EVs. Before, Tesla was virtually the only viable EV player in the market. When new competitors enter, consumers looking for a new EV won’t automatically default to Tesla, thus jeopardizing their ability to sustain gigantic market share.

Tesla EV market share (Counterpoint)

Furthermore, Elon Musk’s conservative orientation is not helping Tesla’s case regarding their consumers. Although I typically don’t discuss politics, Musk is heavily associated with Tesla’s identity. This is important to note when the majority of potential EV buyers are left-leaning, and Musk’s outspoken support for Donald Trump and conservatives presents a genuine threat to Tesla in terms of their customers’ reluctance to buy Tesla’s.

Technology:

For the longest time, Tesla’s primary competitive advantage has been its technology. Due to Tesla’s first-mover advantage in the EV market, they have been ahead of their competitors regarding battery technology and software within their vehicles, yet, this advantage is slowly beginning to dwindle. Tesla has long been able to produce batteries at the cheapest price among all of their competitors. However, automakers such as Toyota and GM, who have more capital to spend than Tesla, have begun making significant investments in battery technology. Although Tesla is still ahead in the battery game, it is only a matter of time before their competitors get closer with their more abundant resources and manpower.

Furthermore, Tesla’s full self-driving (“FSD”) performance is also lackluster and has been underwhelming in its performance. For instance, Tesla recently gave all of its users a free trial of FSD, where an astounding 98% of users opted not to purchase it.

I believe the problem with users reluctant to buy FSD comes from two main areas. Not only is the service itself underwhelming, but it is far too expensive for consumers to justify purchasing it. Although Tesla has lowered the price of FSD recently, it still costs $8,000 to initially purchase it and $99 a month. Long term, this is evidently not sustainable, especially considering the technology itself is not a full-autopilot, although it has improved a lot.

The more alarming part about Tesla’s technology is the entirely new liability it opens the business up to. Automakers have faced liability in the past due to manufacturing issues that could harm their customers, but Tesla’s claims about FSD have already and is likely to continue opening up the business to liability in the event of crashes. Essentially, factors such as potential liability and consumer reluctance to trust the technology will also serve as major factors that slow down the scale at which Tesla can distribute their software.

Valuation:

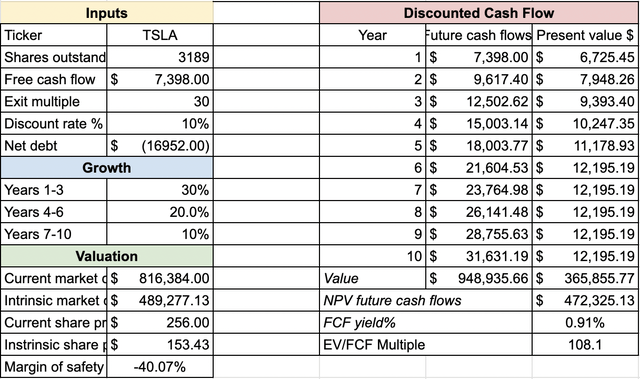

To value Tesla, I used a discounted cash flow (“DCF”) model. Within the DCF model, I inputted extremely generous assumptions to demonstrate how overvalued Tesla is. First, I used Tesla’s operating income to represent their profitability, even though their free cash flow is significantly worse than their operating income. Then, I put an exit multiple of 30, which is twice the market average over long periods of time and multiples higher than all other automakers. I then put the discount rate as 10% which is what the market does over long periods of time (I typically use 13% because when investing in individual stocks I obviously want to beat the market). Lastly, I inputted 30%, 20%, and 10% growth assumptions for Tesla’s bottom line over the next 10 years in 3 year increments respectively.

The growth assumptions are extremely generous as it assumed that by year 10 Tesla will do over $31 billion in operating income, which is close to what Toyota does today, representing truly monstrous growth. Overall, even with these extremely generous assumptions, Tesla still appears to be trading significantly above its fair value.

TSLA DCF Model (Rasoli Research – Seeking Alpha Financials)

According to the DCF model, even with very generous assumptions, Tesla’s intrinsic value is roughly 40% lower than what it trades at today. Essentially, this valuation, paired with the negative factors surrounding the business, leads me to believe there is significant downside to this equity.

Final Thoughts:

Overall, I believe that Tesla is a good business and industry leader in the EV space. However, the business faces many fundamental challenges going into the future. Not only is the business capital intensive and faces extreme competition, there are large hurdles that may limit the business’ growth.

Although Tesla, Inc. can still achieve significant growth over the next decade, the stock trades at extreme multiples, which prices in tremendous growth. I believe that Tesla will face multiple compression as the tremendous growth prospects the market anticipates does not come to fruition and their competitive advantage begins dwindling over time as other automakers with more resources catch up. I can absolutely be wrong about Tesla, but only time will tell.