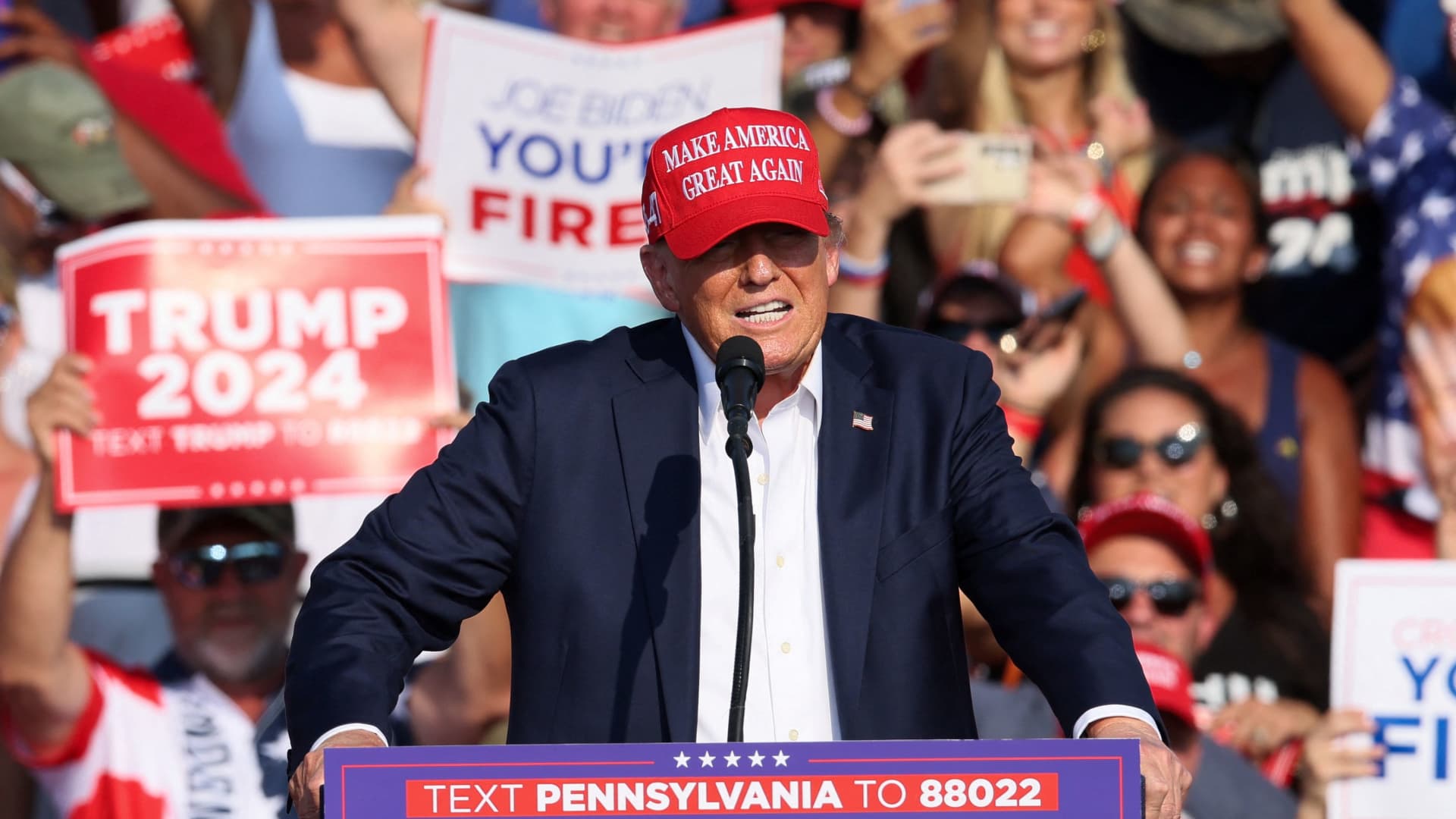

Republican presidential candidate and former U.S. President Donald Trump speaks during a campaign rally at the Butler Farm Show in Butler, Pennsylvania, U.S., July 13, 2024.

Brendan Mcdermid | Reuters

U.S. stocks are expected to get a short-term boost in the aftermath of the failed assassination of former president Donald Trump over the weekend, as analysts say the likelihood of his re-election in November has increased.

U.S. futures rose overnight as investors reacted with “relative optimism” to the prospect of a second Trump presidency, Rob Casey, partner at markets advisory firm Signum Global Advisors, told CNBC’s “Squawk Box Europe.”

Crypto markets also rallied — with bitcoin rising as much as 5% Monday to top $63,000 — on hopes of a more positive landscape for the digital asset under a Trump presidency.

“The events on Saturday, if they do anything, they strengthen the case for President Donald Trump to win the election in November. I think that’s what the markets have reacted to,” Casey said.

Polls showed Trump retaining his lead over President Joe Biden a day after the shooting at a Republican rally in Pennsylvania. Betting odds, meanwhile, surged.

It follows already dwindling support for Biden, even among his Democratic voter base, amid concerns over his cognitive abilities. Casey said the weekend’s events also provide a reprieve for Biden, who has been under pressure to stand down, and all but guarantees his candidacy in November.

Risk consultancy firm BMI, part of Fitch Solutions, said in a note to CNBC that Trump’s odds of winning the election had risen significantly, which “could be positive ahead of the election as it reduces electoral uncertainty.” But it added that any boost was likely to fade.

Guillaume Menuet, head of investment strategy and economics for EMEA at Citi Global Wealth, agrees. He told CNBC that the weekend’s events were likely to drive markets for a “couple of days” before investor attention returns to the real economy.

“These events, as unfortunate as they are in terms of political change, do not really change the direction of global markets and the global economy,” he said Monday.

Indeed, with more than three months to go until the Nov. 5 run-off, Casey said it was too soon to make a call on the longer-term market impact, with a slew of political events likely to add to volatility over the coming months.

One person was killed and two others critically injured during Saturday’s attack, prompting both Trump and Biden to call for calm and unity amid concerns of rising political divisions and possible further violence.

“It’s probably too far between now and November to be especially bearish or bullish. What we’ve seen over the last month or so, and what we will likely see over the coming months, is frankly volatility point blank, period,” Casey said.

What a Trump win could mean for markets

Veteran investor David Roche, president of Quantum Strategy, said in a note Sunday that a Trump presidency — which is now his prediction — would be bad news for markets, given his protectionist geopolitical stance.

“Tariffs would hit U.S. inflation and growth. U.S. Fed cuts would end. This would mean the end of the bull market,” he said.

Meanwhile, Nomura’s Gareth Nicholson, in a note to CNBC, said a Trump presidency would mark an overall “negative risk factor” for Asian stocks, and Goldman Sachs said in a Friday note that European markets would also be hit by fresh trade policy uncertainty under a new Trump administration.