Wirestock

Investment Thesis

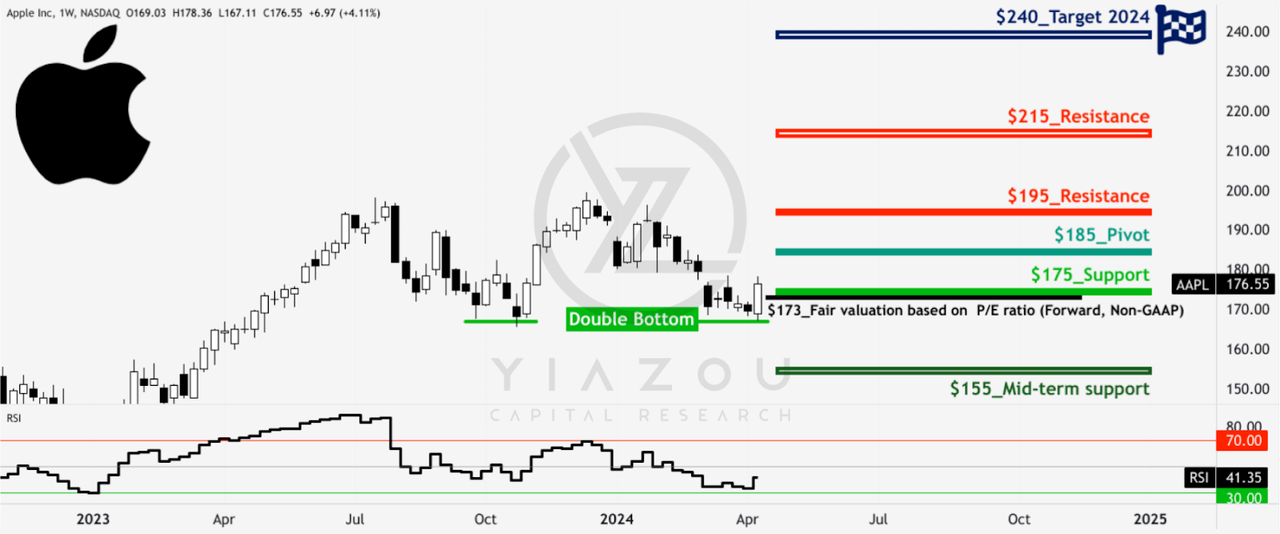

Since our last update two months ago, in which we wrote up a bullish thesis with an end-target price of $240 by the end of 2024 for Apple Inc. (NASDAQ:AAPL), the stock has returned 24%, much closer to our target price and leaving space for a little more upside.

Having started the year at $185, its shares traded sideways, but AAPL is up about 15% YTD. However, the company has underperformed both Microsoft and the broader market. Microsoft’s (MSFT) stock is up 22% YTD, and the company has eclipsed Apple as the most valuable company by market cap. Nvidia (NVDA) is more than 157% higher this year as the frenzy around AI continues to lift its stock.

Despite Apple’s strong performance and continuous innovation, this relative underperformance compared to MSFT and NVDA speaks to the dynamism and competitiveness within the tech landscape. In particular, Nvidia’s remarkable growth, driven by AI, may indicate opportunities for Apple moving forward.

AAPL has recently encountered resistance at the $215 level, previously indicated in our last update. Our $240 end-2024 target price remains intact, considering Apple’s robust financial health and the upside potential from new technologies it can leverage. However, there is limited upside from current levels, leading to our revised hold rating for the stock. While we are very optimistic about AAPL, one must be cautious in a changing marketplace.

Author (Last Technical Analysis 15 April 2024) (trendspider.com)

iPhone Woes Drag Apple Down: Revenue Declines Amid Stiff Competition and Sluggish Sales

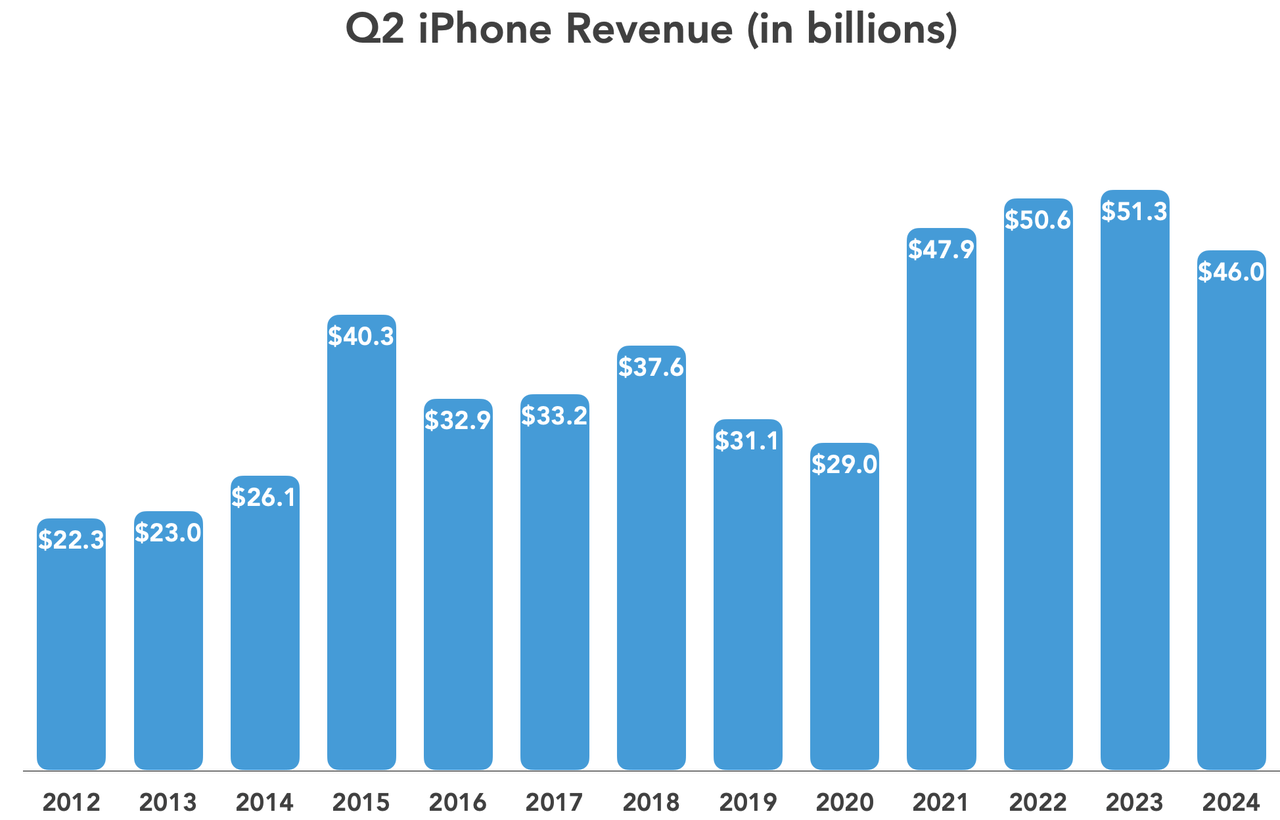

Apple’s poor performance compared to its competitors is linked to increasing worries regarding its main iPhone operation, which makes up roughly 51% of its overall revenue. Sales of iPhones have faced significant challenges over the past few years due to a decrease in the rate of new phone purchases. The tech company experienced the sharpest drop in iPhone sales since the start of the pandemic during the first quarter of the year.

iPhone sales dropped by 10% to $45.9 billion in Q2 2024, affirming weakness in a product that Apple has always relied on for a good chunk of its revenues. Unlike in the July-September 2020 quarter, when iPhone sales slumped due to production bottlenecks, the drop in 2024 came from customers shunning the current flagship product. Customers have shied away from the iPhone 15, citing a need for new groundbreaking features to warrant an upgrade.

Consequently, Apple recorded a 4% decline in revenue in the fiscal second quarter to $90.8 billion. The decline marked the fifth consecutive quarter in which Apple reported a revenue dip. The decline came as Apple suffered an 8.8% drop in sales in its biggest market, China, at $16.37 billion. The company is under immense pressure from local manufacturers, including Huawei and Oppo.

Tidbits

Apple’s Secret Weapon: Soaring Service Revenues Offset iPhone Struggles Amid Lucrative Google Deal

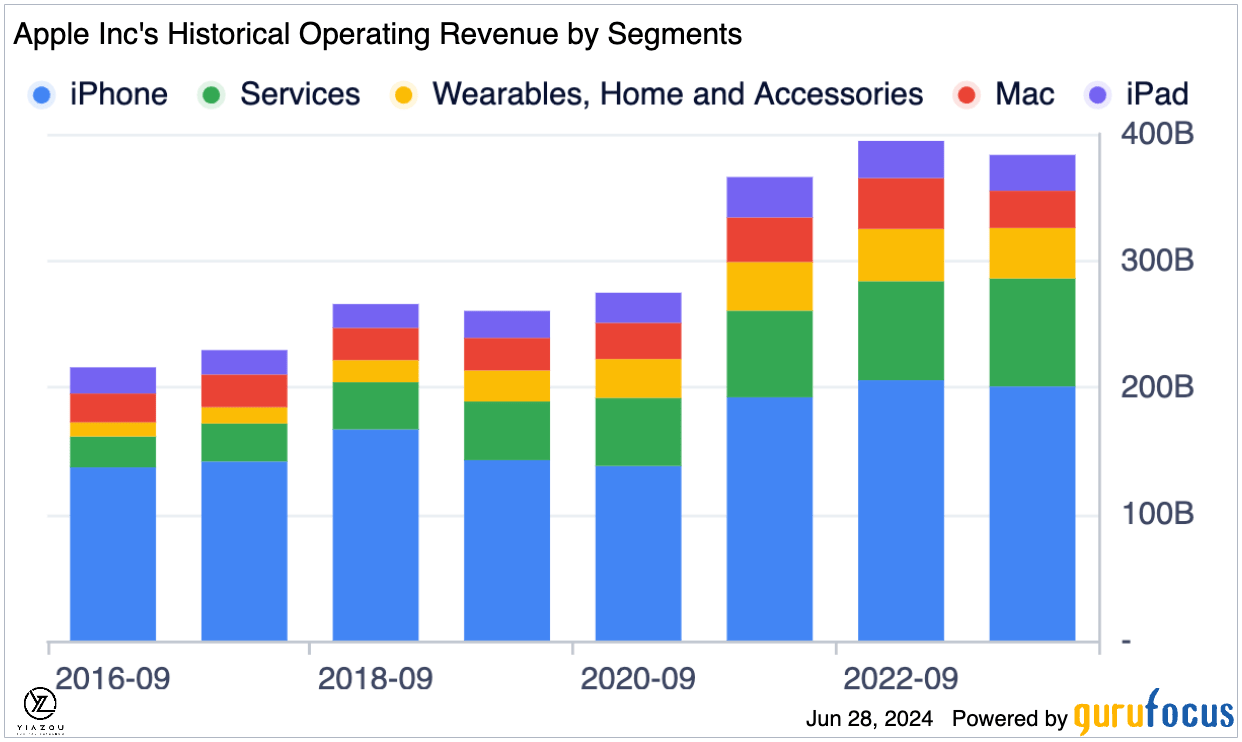

Nevertheless, the services side of the business is emerging as an important frontier that could help cover declines on the hardware front. Apple recorded a 14% increase in service revenues to $23.87 billion involving its cloud unit, App Store and Apple Music.

Additionally, the service division dramatically benefits from a lucrative contract with Alphabet (GOOG) (GOOGL) that locks in Google as the default search engine in iOS devices. Unsealed court documents indicate that Google paid Apple $20 billion as the default search engine. It has also emerged that Google pays Apple up to 36% of its revenue from search ads on iOS devices, which could account for a significant chunk of the total service revenues.

The lucrative nature of the Google search deal is believed to have been one reason Microsoft offered to share up to 90% of its search ad revenue with Apple if its Bing search was made the default search tool in Apple devices. CEO Satya Nadella, in court filings, has already indicated that they were willing to make significant concessions to persuade Apple to make the switch.

The revenue dip also resulted in a 2% profit, totaling $23.64 billion or $1.53 a share. Nevertheless, Apple still boasts a solid operating margin of 28% over the past five years, which any business in a competitive sector would love to maintain. The services segment’s impressive gross margin of 74.6% significantly contributes to the favorable overall margin product mix. Therefore, as the company generates more revenue from services, it is expected to boost its margins.

GuruFocus

Increased Dividends and $110 Billion Buyback Amid iPhone Sales Slump

Even as Apple struggles with declining iPhone sales, it has again underlined its ability to return optimum value to shareholders. The Cupertino-based company has announced a 4% increase in quarterly dividends to 25 cents a share. The stock currently boasts a 0.47% dividend yield with a 14.93% payout ratio.

In addition to dividends, Apple has also reiterated its push to continue reducing the amount of its shares in circulation. Consequently, it has committed to returning $110 billion to shareholders through buybacks.

While investors welcome the multibillion-dollar buyback, Wall Street enthusiasts have criticized it, arguing that the funds should be directed toward innovation. Amid the concerns, Apple still had $101.9 billion in free cash flow as of the end of the fiscal second quarter, which leaves it in a solid financial position to pursue any investment that has the potential to strengthen its hardware and software products.

Apple Doubles Down on AI

Likewise, Apple is already putting its solid balance sheet to great use. Having been accused of lagging on AI innovations as Microsoft and Google are spearheading the race. The company is turning to AI to harness the technology and make its products more useful. Thus, Apple has long incorporated its Neural Engine Neural Processing Unit (NPU) into its processors for on-device machine learning, such as intelligent photo processing.

In a strategic move unveiled at the recent Worldwide Developers Conference (WWDC), Apple announced it would leverage these Neural Engines to power generative and large language models on its main products. This is a classic Apple approach: laying the groundwork in advance and releasing new features when they can provide the ideal user experience and solve customer pain points.

Recent developments at the Worldwide Developers Conference highlighted how serious Apple is about pursuing AI development and features that have the potential to revolutionize its product line. Apple Intelligence is Apple’s new AI service designed to boost product sales by bringing generative updates across various iOS product lines. The platform will change how people interact with technology by blending advanced machine learning and AI capabilities.

Forbes

Some of the touted AI features that could make their way into the latest iPhones, Macs, and iPads include AI capabilities for generating images and language. Plans are also to introduce AI-powered editing tools and an updated Siri that’s more user-friendly and effective in responding to users’ requests and prompts.

Apple intelligence should allow users to proofread their work and rewrite sections where necessary. It will also enhance the way people summarize text across various ecosystems. When creating images, people can spin up generated images within seconds using animation illustration and sketch styles.

Another clear indication that Apple means business on AI is that it has inked a strategic partnership with Open AI, an AI startup bankrolled by Microsoft. The strategic partnership paves the way for the integration of ChatGPT into Apple devices.

The integration of various AI features could be why millions of customers will upgrade their iPhones, Macs, and iPads, therefore driving hardware sales that have been slowing down. Likewise, the various AI features should accelerate demand for Apple services, including its cloud computing solutions, which should drive revenue growth.

The introduction of Apple Intelligence across a broad range of devices signifies Apple’s commitment to deeply integrating AI into its ecosystem, enhancing hardware and software user experiences. This move could drive hardware upgrades and increased demand for Apple’s services, fostering revenue growth.

Bottom Line

Apple devices have always been a force to reckon with, given their advanced security features and specs that make them stand out. While iPhone sales have declined recently, brand loyalty remains intact, with people waiting for groundbreaking features to upgrade. Apple’s investment in generative AI features and strategic AI partnerships promises to be a game changer that will revitalize growth in hardware sales.

The company’s increased focus on AI has been the catalyst behind the stock bouncing back in recent weeks. The potential impact of AI on Apple’s hardware and services must be considered. Given that the company outperforms other tech giants on free cash flow generation affirms why it is well equipped to catch up to its competitors on AI and strengthen its growth metrics.