makasana

Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk recently called on Warren Buffett to take a stake in Tesla. But a Tesla stake is not a great fit for Buffett or any other value investor. I wrote that Tesla was not a value play, to say the least, in my previous article, and my opinion has not changed. The latest earnings results published on April 23 suggest that the company’s fundamentals are only deteriorating. In this article, I would like to update my readers on the company’s earnings, news, developments, and valuations.

My previous analysis on Tesla

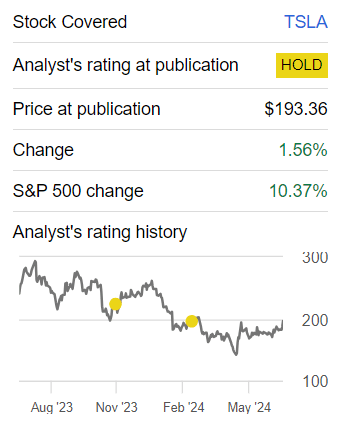

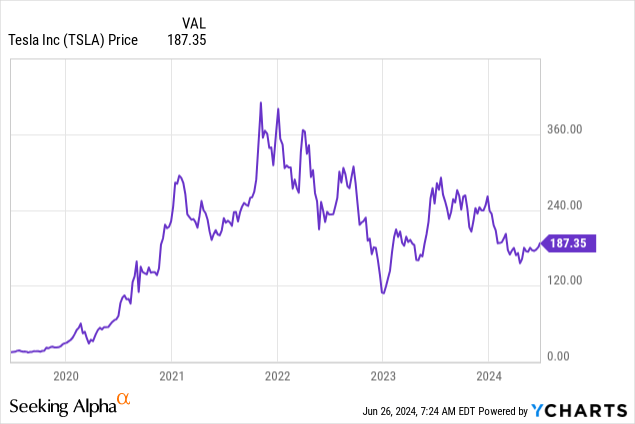

Earlier in my previous article, I was also quite skeptical about TSLA. I pointed to the company’s falling profit margins and dropping auto deliveries. The most important part of the company’s business, namely EVs, was showing decline, instead of the slower growth that was the case a year ago. I also admitted the debt level was quite low, something which is also the case now. Well, the situation has not changed much. In fact, Tesla’s sales and car deliveries decreased while its operating expenses increased since my last coverage. The stock price, meanwhile, stayed almost unchanged, only rising by 1.56% as I am writing this, as opposed to the S&P 500 (SP500), which increased by more than 10%.

Seeking Alpha

Tesla’s earnings

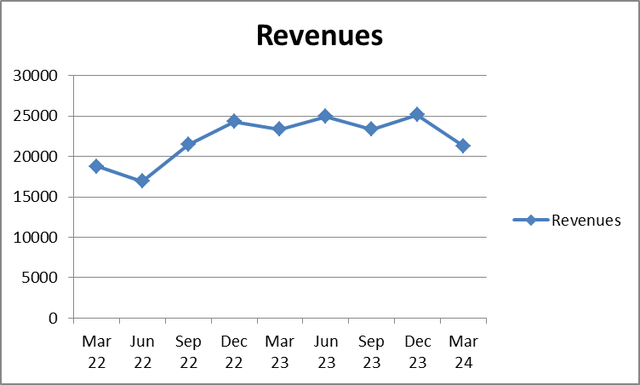

A lot has already been written about Tesla’s quarterly earnings here on Seeking Alpha. So, without going into too many details, I can only say that the company’s quarterly accounting data keeps deteriorating. This is true of the company’s revenues and, quite paradoxically, of its operating expenses. Tesla reported a 9% drop in its total 1Q 2024 revenue, the steepest year-over-year decrease since 2012.

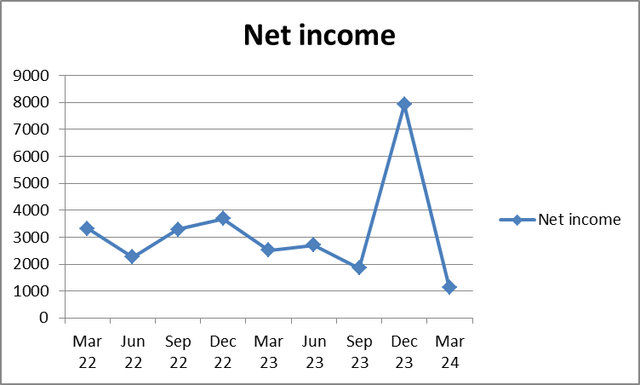

Expenses normally decrease when revenues fall. But the situation is quite the opposite with Tesla. The total operating expenses increased from $2,374 million in 4Q 2023 to $2,525 million in 1Q 2024. Obviously, the net profit margin decreased as well. The decline totaled 55%. In 4Q 2023, the net income was $7,928 million, while in 1Q 2024, it totaled just $1,129 million.

But let us see Tesla’s quarterly sales and net profit history.

Tesla’s revenues in millions USD

|

Date |

Mar 22 |

Jun 22 |

Sep 22 |

Dec 22 |

Mar 23 |

Jun 23 |

Sep 23 |

Dec 23 |

Mar 24 |

|

Revenues |

18756 |

16934 |

21454 |

24318 |

23329 |

24927 |

23350 |

25167 |

21301 |

Source: Prepared by the author based on Seeking Alpha’s data.

Prepared by the author based on Seeking Alpha’s data

From the table and diagram above, we can clearly see that Tesla’s revenues have declined to the level seen in September 2022.

Tesla’s net income in millions USD

|

Date |

Mar 22 |

Jun 22 |

Sep 22 |

Dec 22 |

Mar 23 |

Jun 23 |

Sep 23 |

Dec 23 |

Mar 24 |

|

Net income |

3318 |

2259 |

3292 |

3687 |

2513 |

2703 |

1853 |

7928 |

1129 |

Source: Prepared by the author based on Seeking Alpha’s data.

Prepared by the author based on Seeking Alpha’s data

As concerns Tesla’s net profit, it has not been doing well the past quarters either. Only the Q4 2023 period was rather an exception. But overall, the trend does not seem to be Tesla’s friend.

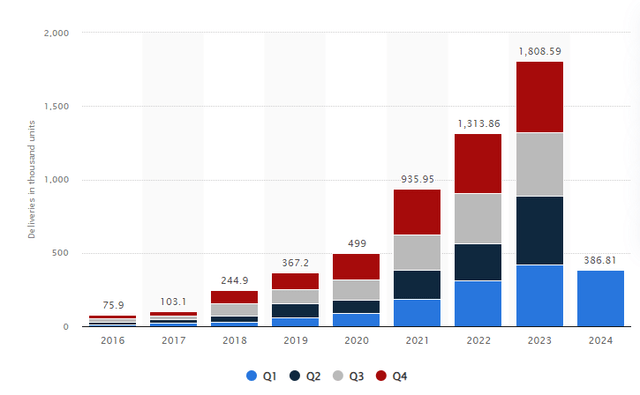

At the beginning of April, 1Q 2024 Tesla’s EV deliveries report was published. Compared to the 4Q 2023 report, the company’s deliveries plunged from over 484,000 vehicles to just 386,810 cars in 1Q 2024.

The graph below shows the company’s EV deliveries in thousands of units. Although on an annual basis, it seems like Tesla did an impressive job because its total 2023 deliveries were higher than its 2022 EV deliveries, the recent result of 386,810 EVs is even worse than its 4Q 2022 result. Not good for a high-growth company.

Noteworthy is that EV deliveries are Tesla’s primary source of growth. And the company itself is perceived as a high-growth investment. But let me also cover the company’s other news.

Tesla’s news

First, Tesla issued two new recalls for the Cybertruck. That was due to windshield wipers with faulty motor controllers, and also due to loose trim that can rattle or fall off. Interestingly, the recalls are the third and fourth in the US for Tesla’s newest EV, which the company only started delivering to customers in late 2023. This is a very poor sign. Although the model has only recently begun shipping, four recalls have already happened.

Moreover, Tesla cut its workforce from 140,473 on December 31, 2023, to just over 121,000 people, according to the last report. This is not typical of a rapidly expanding company. Quite the opposite is true. Tesla seems to expect its EV production to be lower in the next quarters or even in a couple of years.

The macroeconomic outlook appears to be rather grim. According to Cox Automotive, US car sales are expected to fall during the second half of 2024. US sales growth is forecast to slow during the second half of the year to total 15.7 million units at the end of 2024, almost a 1.3% rise compared to 2023. Car inventory levels are rising, and there is growing uncertainty around the economy’s health, namely that interest rates are increasing, while the US presidential election will happen soon. So, carmakers have to offer their products at lower prices. That is generally good for consumers. Some of them have been waiting for years to buy a new car discounted, but this is clearly a headwind for automakers.

Apart from the generally grim economic outlook for carmakers, some traditional auto manufacturers have come up with new incentives to offer more EVs. For example, Volkswagen recently invested $5 billion in EV startup Rivian (RIVN). Even though it could take years for the move to pay off, similar actions can be taken by other large and well-established companies, like Mercedes (OTCPK:MBGAF) or Toyota (TM). So, competition for Tesla seems to be rising.

Why Tesla is still not a value play

According to Investopedia, a value stock is one that is “trading at levels that are perceived to be below its fundamentals.”

Moreover, value stocks should pay dividends because the issuing company has less need for capital to finance growth as opposed to growth shares, which tend to rely on cash for development. In recent quarters, Tesla has not been a growth story due to its deteriorating financial indicators. But Tesla is not a value stock either because common characteristics of value shares include a high dividend yield, a low price-to-book (P/B) ratio, and a low price-to-earnings (P/E) ratio. Finally, a value stock normally has a bargain price as stock market participants see the company as a poor investment.

The situation with Tesla is quite the opposite. Its earnings fundamentals are not brilliant, while its stock price is still extraordinarily high. However, the share price has not been rising in value this year.

In fact, it is substantially below the highs seen in 2021 and 2023, now lingering at less than $200 per share.

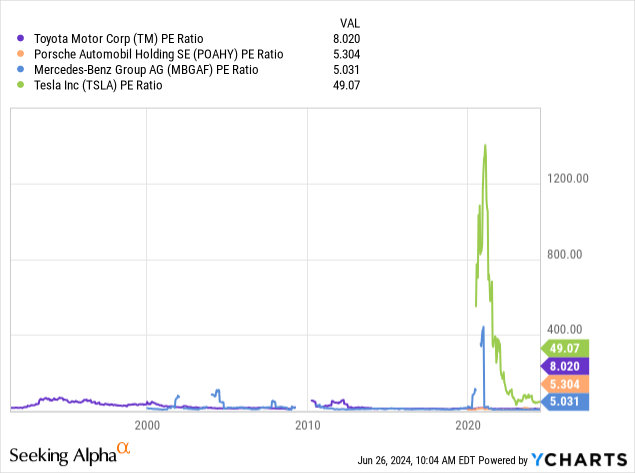

But I still insist that the stock is ridiculously high. To start with, let us look at the company’s price-to-earnings (P/E) ratio and compare it to those of the company’s close competitors.

According to Y-Charts and as I am writing this, Toyota is trading at a P/E of about 8, Porsche AG (OTCPK:POAHY) at a P/E slightly higher than 5, and Mercedes (OTCPK:MBGAF) also has a P/E of about 5. Tesla’s P/E is about 50. Toyota, Porsche, and Mercedes are ordinary car manufacturers with strong brand names, but they also produce EVs. But still, the fact that Tesla’s P/E is 10 times higher does not seem to be justified.

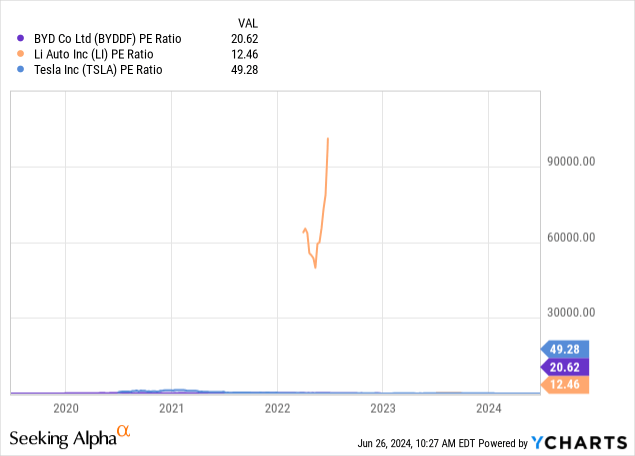

Even if we assume that TSLA deserves to trade at such a premium to ordinary carmakers, let us also check the P/E ratios of pure EV companies, namely Li Auto (LI) and BYD Company (OTCPK:BYDDF).

As illustrated by the graph above generated by Y-Charts, both LI (with a P/E of less than 13) and BYD (with a P/E of about 21) trade at substantially lower multiples than Tesla.

So, the explanation why Tesla is so expensive does not lie solely with EVs, it seems. In my opinion, investors are so enthusiastic about Tesla because of its CEO’s charismatic personality, the fact that the company was the first to launch EVs, and also because of the broader expectations of fully autonomous driving.

Tesla promised to present its long-awaited robotaxi on August 8 this year. This seems to keep the company’s stock price elevated. Tesla’s robotaxi, or fully autonomous vehicle, appeared to be something for the 2030s. Everyone is waiting for 8 August. But if the company does not meet expectations, which is a likely scenario, then the TSLA stock price will probably plunge. This is one of the downside risks.

Risks

But there are also upside risks to my rather bearish thesis. These are the following:

- The first risk is that Tesla’s management comes up with a popular innovation that will be easy to monetize and difficult for its competitors to copy. A good example of this is full automation, which is hardly achievable. Musk believes that driverless cars will one day make other vehicles outdated. This might happen, indeed. However, the key question is “When?”

- If Tesla eventually introduces a robotaxi, robotaxis are projected to have high profit margins, with the company cutting out many middlemen, and providing direct-to-customer services. But the question of timing is also critical here.

- There is a risk that Tesla will further increase its market share in China. However, the Chinese EV market is dominated by companies like BYD, Xpeng (XPEV) and Li Auto.

- Strong economic growth and rising EV sales all over the world are also some upside risk factors for Tesla. But given high interest rates, these things are unlikely to happen in the near future.

- The company’s loyal fans. This is true of both eager investors willing to buy TSLA stock and Tesla’s EV admirers, loyal to the brand. They can support both the company’s sales and its stock price.

Conclusion

In conclusion, I would say that Tesla, Inc. is a risky investment because its growth does not match its stock price. In other words, the valuations are high, while the margins are declining and the car deliveries disappoint. I am still neutral on the stock because it is quite resilient to the bad news. Moreover, some positive changes can make the share price soar. But I would not personally touch the stock because its price is ridiculously high.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.