Victor Golmer/iStock Editorial via Getty Images

Tesla: The Hardships Of Opening A Debate On The Stock

Tesla, Inc. (NASDAQ:TSLA) is a stock I rarely write about. In fact, this is just my third article in over two years on Seeking Alpha. This doesn’t mean I don’t follow the company closely, as I am deeply interested in the automotive industry. Yes, here many would stop me and immediately tell me: “What are you saying? Tesla is no car company, it is a tech company, an AI company, etc.” and so on. As far as I have experienced, dealing with Tesla inevitably carries along a relationship with many investors who are also fans of the company. This makes what I am about to do extremely risky.

So far, I have dealt with the company by tackling the main issue I see behind it: to value it properly, investors must decide whether it is an automaker or a tech company. As for me, even though CEO Elon Musk says otherwise, I am on the automaker side, and I say this based on its financials.

Since I follow many automakers, now and then I gather some news on the overall industry that makes me write some macro considerations. At the end of last year, after listening to Mercedes-Benz’s earnings call, together with other big automakers such as Volkswagen and Stellantis, I wrote an article on the “bad news” that these companies were bearing for Tesla. As a matter of fact, it turns out that it indeed became rather difficult for Tesla, which dropped to the low $140s in late April. Since then, however, the stock has recovered a bit and now trades just below $190 thanks to an overall bull market and to a few announcements Elon Musk has made, recreating a new narrative around the stock thanks to the Robotaxi fleet.

The Issue With Cathie Wood’s Forecast

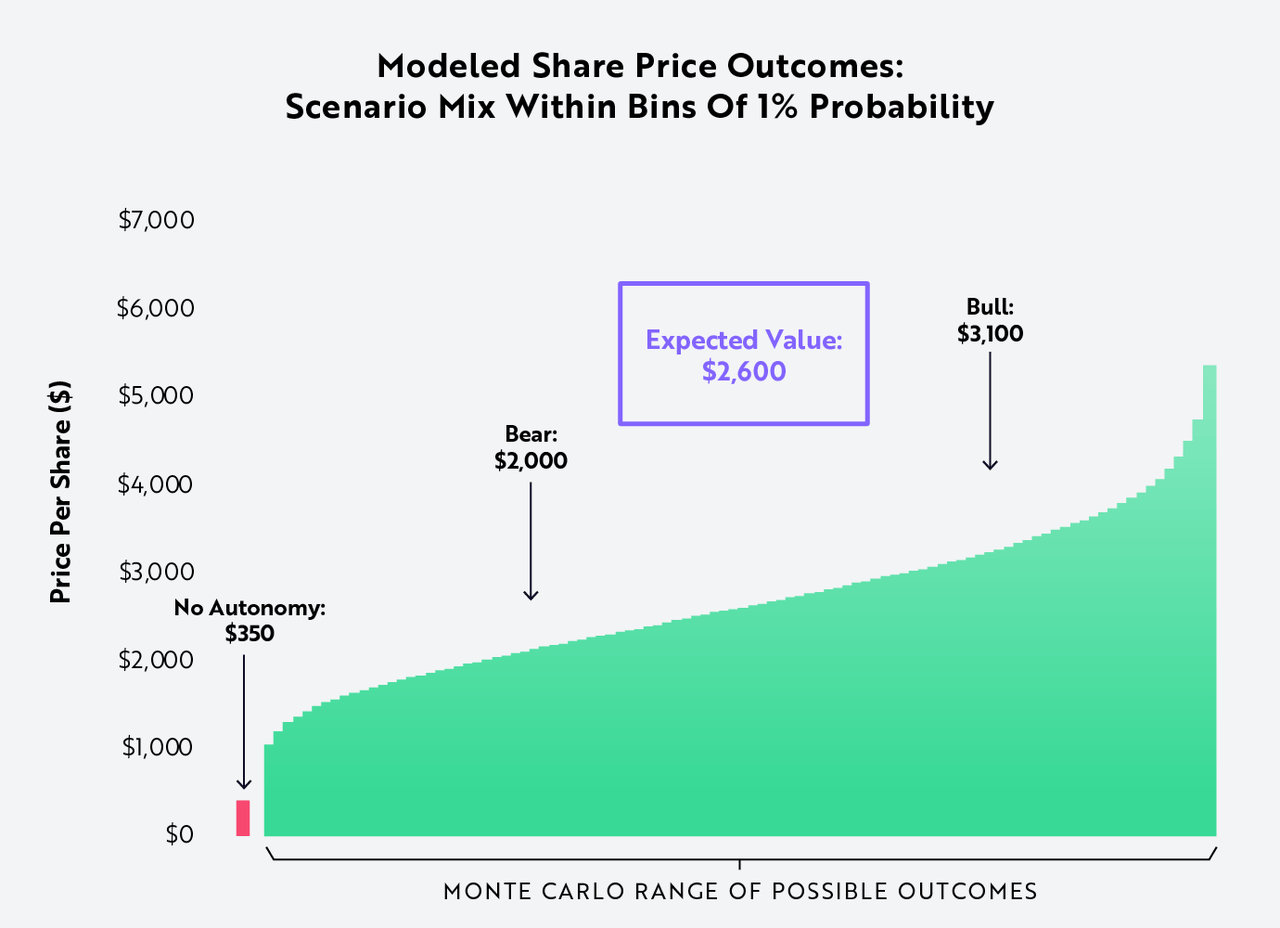

Now, after I read a few days ago that Ark Invest’s Cathie Wood put a $2,600 price target on Tesla, I would like to share my view once again. We can see below the range of possible outcomes, with one caveat: autonomy will be the key. If now autonomy is released, then the stock will only go up to $350, which means the stock will in any case appreciate over 13% per year from here through year-end 2029. In any case, it seems it will be impossible to lose money on Tesla.

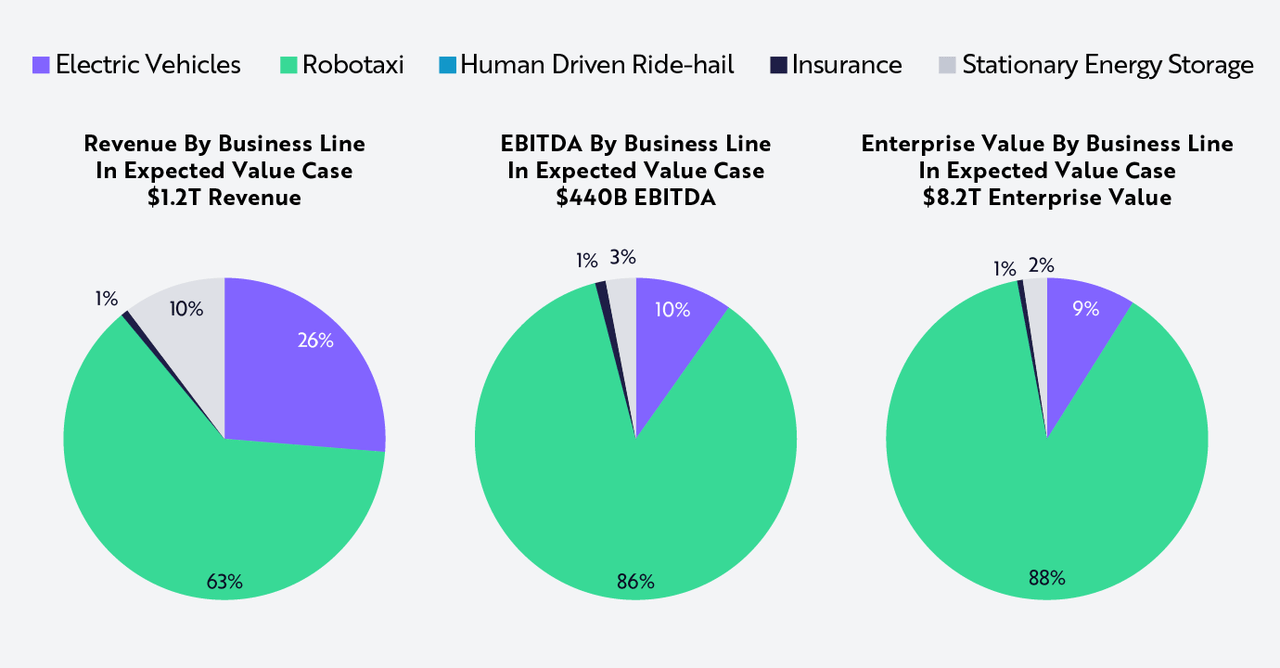

What will drive Tesla stock to these record highs? It won’t be exceptional EV sales, which Ark Invest forecasts to make up only 25% of Tesla’s sales by 2029. The true golden goose will be the robotaxi business, which could make up 63% of Tesla’s revenues in 2029.

Ark Invest’s bear case scenario sees Tesla’s market cap around $7 trillion by 2029, with 5.8 million cars sold generating $250 billion in revenue and $603 billion coming from autonomous ride-hail revenue.

Ark Invest believes Tesla will launch its robot-taxi service by 2026 and that the probability that Tesla fails to launch within 5 years is less than 0.01%.

Then, suddenly, we find these words: “While unlikely, if we were to eliminate the possibility of a robotaxi network from our model, our price target would be ~$350.” However, Ark Invest is quick to note that, even in the case of no robotaxi launch, Tesla could “launch a human-driven ride-hail service for both strategic and tactical reasons.”

Tesla is expected to have a take rate of around 50%, against Uber’s 25%.

Since Ark Invest has to face the reality of flat vehicle production in 2024, it then projects a 45% CAGR growth through the end of 2029, scaling from 1.8 million units to around 11 million by 2029. But most of these sales will come from robotaxis, which should ease manufacturing scaling because of their simplified design.

The thesis on Tesla then becomes the following: “Its business model should transform from one-off vehicle sales to a recurring revenue base as every car becomes an AI-powered cash flow generation machine.”

What should we make of these predictions?

Well, Tesla CEO Elon Musk did announce that on August 8th, he will unveil the Robotaxi, stating “It will result in a cost per mile cheaper than subsidized bus tickets.” True, originally it was predicted to be available in 2020. We don’t yet know if the unveiling date will immediately lead to production, or if Tesla will need more time before developing it fully. However, it seems Tesla is moving forward and should soon produce this long-awaited product.

This announcement was surprising and surely sparked a lot of interest, as Tesla was rumored just a few months ago to have canceled its plans to mass-produce a $25,000 EV. After all, the inevitable price battle Tesla was fighting with BYD and other Chinese EV makers was squeezing Tesla’s margins and leaving less room for massive investments with lower returns.

However, it seems now that Tesla has combined the $25,000 car project with the Robotaxi, developing one model with two uses.

During the last earnings call, Elon Musk was able to spark once again interest in this project, explaining how he thinks about the fleet:

think of it as some combination of Airbnb and Uber, meaning that there will be some number of cars that Tesla owns itself and operates in the fleet. There will be some number of cars and then there’ll be a bunch of cars where they’re owned by the end user. That end user can add or subtract their car to the fleet whenever they want, and they can decide if they want to only let the car be used by friends and family or only by 5-star users or by anyone at any time they could have the car come back to them and be exclusively theirs, like an Airbnb. You could rent out your guest room or not, any time you want. So as our fleet grows, we have 7 million cars going to – 9 million cars going to, eventually tens of millions of cars worldwide. With a constant feedback loop, every time something goes wrong, that gets added to the training data and you get this training flywheel happening in the same way that Google Search has the sort of flywheel, it’s very difficult to compete with Google because people are constantly doing searches and clicking and Google is getting that feedback loop. It’s the same with Tesla.

Now, as far as this may sound interesting, I found it strange that the leader of such a worldwide known brand as Tesla needs to compare its company to Uber (UBER) and Airbnb (ABNB) as if the only way of explaining what he has in mind comes from what two other companies are already achieving. Of course, he named the two companies to make things easier to understand, but, still, it is a way of communicating that weakens Tesla.

Surely, another interesting development is that Robotaxi’s fleet will be flexible and will lead to transportation as a service economy, where owning a vehicle won’t be as necessary as it still is now.

However, Tesla won’t have a monopoly. Zoox, acquired by Amazon in 2020, will be competing, and it has already been testing its taxis in San Francisco and Las Vegas, but it has yet to start commercial rides.

Google is not idle either, with Waymo already operating a commercial ride service in Phoenix, San Francisco, and Los Angeles, and it is currently the largest U.S. robotaxi service with over 500 electric Jaguar SUVs. It is estimated that Google spent around $8 billion so far on this project to generate, as of now, just $50 million a year (the average price per ride is around $20). However, just two years ago, Waymo made only $1 million.

Now, $8 billion is a lot of money, and this is what was needed so far just to get the project started. Imagine the huge capex that will be needed to scale the project up. Of course, enthusiasm may be so high that financing won’t be difficult. But, still, Tesla made just $5 billion in FCF last year and will probably do less this year due to decreasing margins. Simply put, Tesla doesn’t have the money to self-fund this business.

Tesla claims its new FSD will now be using just cameras, avoiding laser LiDAR systems. This clashed with what Luminar (LAZR) disclosed in its Q1 2024 report when it wrote “Tesla was our largest LiDAR customer in Q1, comprising over 10% of our revenue.” It is important to know that it has taken Waymo around 6 years to cover a 315 sq mi region.

As a result, I see the robotaxi project in this way. I am confident that Tesla and some other companies will eventually figure out a way to launch this business successfully. However, before we see any material revenue change from this business, many years may pass (perhaps even a decade). In Ark Invest’s forecast, I see no real grounds on which the robotaxi expectations are founded, especially technologywise.

Now, without repeating what has already been well said on Seeking Alpha, I suggest reading a recent article by Dividend Sensei where he shows how the economics of robotaxis for Tesla don’t make sense under the scenario of a $0.50 cost per mile. He estimates a staggering $45.4 trillion will be needed to fund a global robotaxi fleet. Obviously, he states, Tesla can’t fund this by itself, not even if the stock goes up 10 times and Tesla sells its shares.

Tesla’s Automotive Business: Profitability Under The Radar

Having said this, I have tried to show why I keep considering Tesla as part of the larger auto industry. True, it is no normal player in this industry, as it owns leading technology in electric mobility. However, it is neither a monopolistic player nor a company whose future will soon be impacted by some disruptive change. In a sort of way, if I will be allowed to use this as an example, Tesla is similar to Google, which reports after its main and well-established business lines, the item “other bets.”

It is difficult to predict what will come out of this and, as such, investors don’t consider this when valuing the company. The same is true for Tesla: be it semis, robotaxi, batteries, energy storage, or other bets, it is extremely difficult to predict when these bets will become business and, most importantly, will generate profits. Probably, the most realistic new stream of revenue will come from its charging business, currently generating 1.5% of total revenue. And yet, when Tesla announced a 10% workforce reduction, the supercharger unit was hit the most.

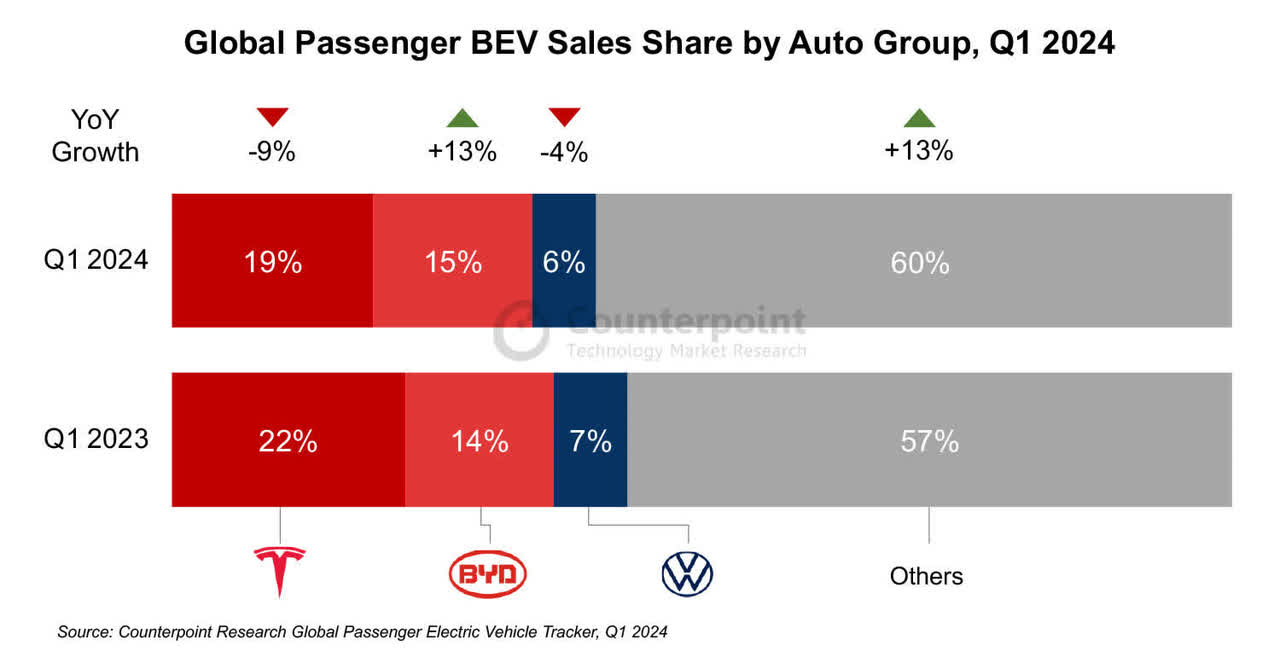

At the same time, 2024 has been so far hard for EV sales, with only a 7% increase globally, but just a +2% YoY growth in the U.S. China, on the other hand, remains the global leader in EV sales with its local players gaining momentum.

At the same time, consumers appear to be shifting towards cheaper PHEVs. Here Chinese players such as BYD (OTCPK:BYDDF), Li Auto (LI), and Geely (OTCPK:GELYF) excel. In China alone, PHEV sales increased 83%, and even though they are still outsold by BEVs by 2 to 1, the fast growth in sales could be setting a new trend among consumers.

If this trend strengthens, Tesla will see its market shrink or at least grow at a slower pace because Tesla has committed to fully electric cars. I don’t think Tesla will ever consider plug-in hybrids because they collide with its ultimate goal of sustainable mobility. Tesla’s Chinese competitors, on the other hand, will have an advantage. BYD, for example, sold almost 1.5 million PHEVs out of 3 million vehicles sold in 2023.

At the same time, Tesla’s sales in Europe dropped to less than 14,000 vehicles in April as other European and Chinese competitors are taking market share.

Even Elon Musk, during the Q1 2024 earnings call, had to discuss “several unforeseen challenges” affecting the company’s main business. For example, a year ago, it took only 25 days for U.S. dealers to sell a BEV, or “days to turn,” once it landed on their lots. This year, the days to turn are 72. ICE vehicles’ turn moved up from 34 to 52. But hybrids are increasingly popular: last year their days to turn were 16, and now they are just 25, meaning demand for hybrids is strong. As a result, GM CEO Mary Barra decided at the beginning of this year to introduce PHEVs in the company’s lineup, after discontinuing their last models in 2019.

The result was that Tesla reported negative FCF of $2.5 billion in the first quarter. Guess what the main reason was? Inventory build greater than deliveries. High inventories lead to price cuts. Price reductions have an impact on used EV prices, too. This has an impact on the financing branches of automakers, which may see the value of the cars they sold in the past two years decrease, creating a potential loss once they take back the used vehicle and resell it. As a matter of fact, as Recurrent showed in its Q2 2024 market report, used EV prices continue to fall.

But Tesla’s financials were also hurt by several price cuts the company put into play to keep its sales up. This hasn’t supported sales enough, and Tesla recently decided to trim its production output in China.

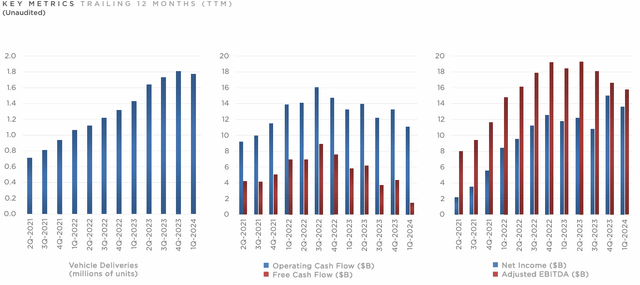

TSLA Q1 2024 Earnings Presentation

As we can see from the three charts above, Tesla’s key metrics still reveal the company is a capital-intensive industrial business: volumes are important and if they are not sustained, the company has a hard time generating cash flow and income.

Total automotive revenues in Q1 were down 13% and Tesla’s gross profit decreased 18%, leading to a gross margin of 17.4%. But opex increased 37% and this ate away a lot of the company’s operating margin, which was reported only at 5.5%. Now, this is very low. Many OEMs are currently reporting higher margins, though competing more fiercely compared to last year. Stellantis, (STLA), for example, is currently the second-best in BEV sales in Europe (after Volkswagen) and can already sell its BEVs at a profit. Overall, Stellantis has double-digit operating margins. Volkswagen is high-singe digits. General Motors TTM operating margin is over 7%. If Tesla will be once again a disruptive company, it can’t just give up its margins because it needs plenty of cash to fund its new endeavors.

Even Services, which is a key business for industrial companies, didn’t perform well, with gross profit down 40% YoY. As Tesla reports: “The biggest driver of gross profit reduction was lower used vehicle profit.”

Valuation

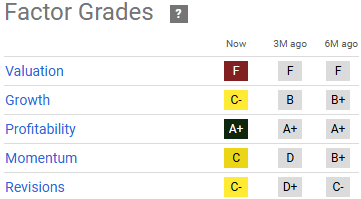

On Seeking Alpha, Tesla’s factor grades don’t currently paint the perfect scenario to invest in the company. On one side – but it has been known for a long time – Tesla’s valuation is extreme: a fwd P/E above 90, fwd EV/EBITDA around 40, and fwd P/FCF above 51 are expensive multiples. Investors are either saying they are willing to wait around 90 years to receive back in earnings what they are paying today or – which is more likely – are expecting explosive growth down the road so that these multiples will be quickly compressed.

Seeking Alpha

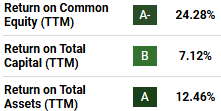

While Tesla has been a growth story so far, we have seen how the current environment is making it hard for Tesla to come out flat YoY. As a result, Tesla’s growth grade is nothing particularly exciting: a C-. Momentum and revisions are also two Cs. What stands out is Tesla’s profitability. Although its gross profit margin is graded with a D-, it earns an overall A+ thanks to its high returns on equity, capital, and assets.

Seeking Alpha

As many readers may know, I value a stock’s profitability grade as the most important. Profitable companies can compound rather quickly, reducing at a fast pace its multiples, with a direct effect on valuation. However, even on profitability, I am a bit puzzled because, although Seeking Alpha gives Tesla an A+, most of its grades are between an A and a C+. So, I don’t understand how the best possible grade comes out. In any case, Tesla’s profitability is excellent. At least, it has been, up to now. As soon as this year ends and the new lower margins are taken into full consideration, we may probably see these grades decrease.

From these grades, we have an overvalued company that is not supported by strong growth.

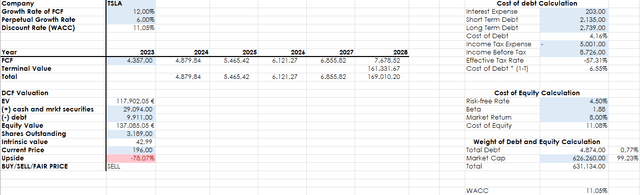

If I run a discounted cash flow (“DCF”) model, I find an even worse result. Although I project Tesla’s FCF to grow 12% annually for the next five years and 6% as its perpetual growth rate, I end up with a target price of $43.

Even if I project a whole decade of earnings, I end up – in the most rosy situation – with almost $170 billion in FCF. I have been generous and have used a 14% annual rate growth rate. However, Tesla’s market cap is currently $626 billion. This means that the company is worth 5 times the sum of all the FCF it will generate in a decade. Now, to me, this is extremely expensive.

Personally, I am no short-side investor. I would never recommend shorting Tesla because it is a stock that can defy gravity and is rather unpredictable. However, I stick to my sell rating because Tesla’s fundamentals currently seem to me to be weakening, while its prospects still depend a lot on a narrative that fails to show material and convincing signs of promising and profitable developments.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.