baileystock

Introduction

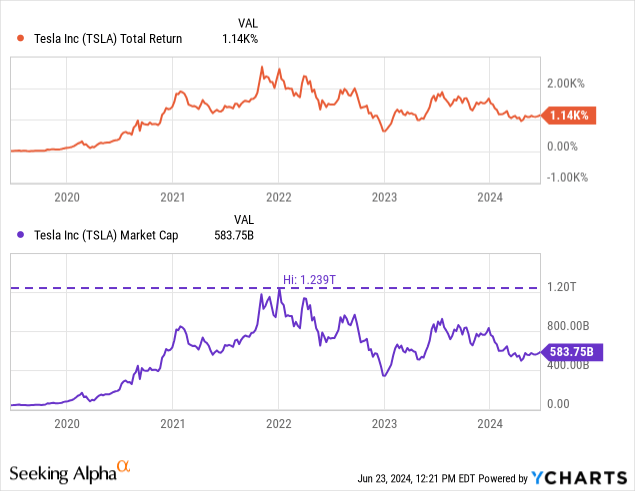

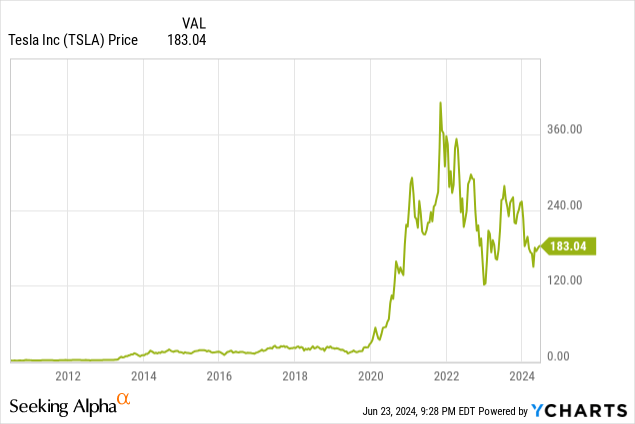

Tesla, Inc. (NASDAQ:TSLA) has had a very rough ride in the stock market since 2022 after its meteoric rise to the trillion-dollar company club that year, now down to around $600B. It has still been a fantastic ride for shareholders, nonetheless, who are still up over 1000% in the last five years.

The Pay Package

TSLA’s most recent news isn’t about its operations necessarily, but instead about its CEO, Elon Musk. His latest pay package, proposed by the Tesla board, amounts to 29 million TSLA shares, worth $56B back in January when a Delaware judge shut it down. Shareholders recently voted to restore this package, now worth closer to $45B with TSLA’s depreciation.

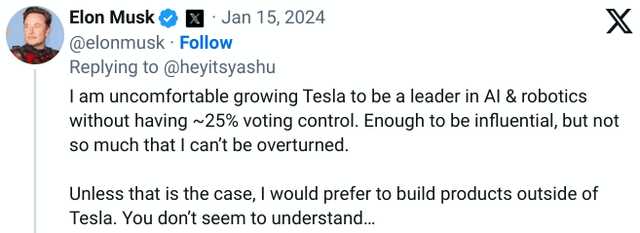

This was done because Musk has said he wants to control at least 25% of TSLA or else he would prefer to focus his AI efforts on other companies that he owns with significantly more control, e.g., SpaceX (SPACE).

And the board acquiesced, prompting the 29 million share payout. Then the judge blocked it.

But now, that package has been approved by a shareholder vote, and the case is currently being floated as having potential to go in front of the Delaware Supreme Court. Consequently, Musk has moved SpaceX out of Delaware and over to Texas.

Can Tesla Afford This?

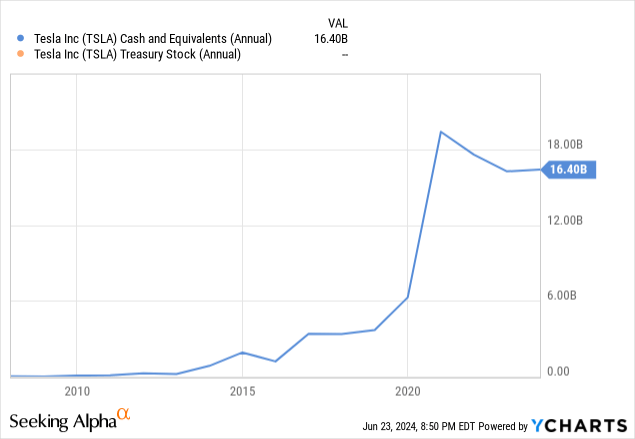

Since the pay package is in stock and not cash, they absolutely can. Tesla, by no means, has that kind of cash on hand. Instead, they will have to print stock.

Note that TSLA’s cash-on-hand is at $16.4B (and I have no idea how much of that is already spoken for internally) and they do not have any treasury stock.

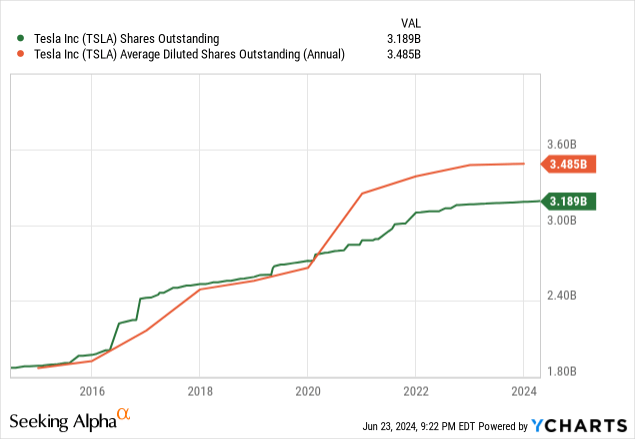

This stock will dilute the pool, making every existing share worth a little bit less. Currently, there are about 3.2B shares outstanding, with another 0.3B in dilutive securities like warrants and options hanging around.

Adding another 29M shares to that pool represents about a 1% increase in outstanding shares. This isn’t actually terrible for Tesla shareholders, since Musk’s leadership tenure has led to significant increases in share price.

Will It Be Enough?

That’s the next major concern: if the pay package is going to represent 1% of outstanding shares, will this bring Musk to his 25% goal?

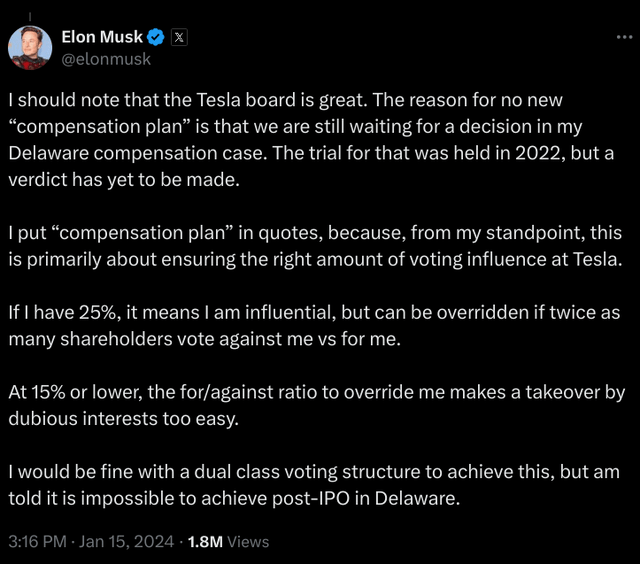

As of late April in an SEC filing, Musk owned 715,022,706 shares in the company. This represents an ownership stake of 22%, still below his original goal. If this pay package goes through, he will own 23% of TSLA. That means they will need to print him another $100B in stock to keep him happy.

I’m with Musk that it would be too difficult at this point to introduce a dual-class share system like Alphabet Inc. (GOOG, GOOGL), so this is the best way to get to his goal without having to buy shares from the market on his own.

To answer the headline question of this section, no. There will need to be more pay packages like this one, or larger, in the future before Musk’s goal of 25% ownership.

Will Tesla Benefit From More Elon Ownership?

This one is difficult to say.

While Tesla has done well under his guidance since 2008, most of that was before he was spread across as many ventures as he has now, particularly X, which he is very active on.

Note: What do you call posts on X now that they’re no longer “tweets”? My preference is “xeet/xeets/xeeting.” Pronounce the “x” there as a “z.”

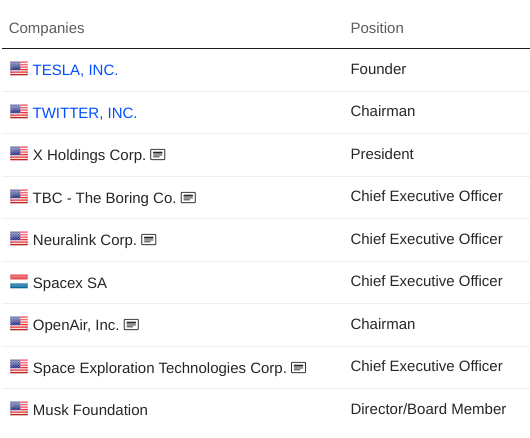

Figure 3 (Market Screener)

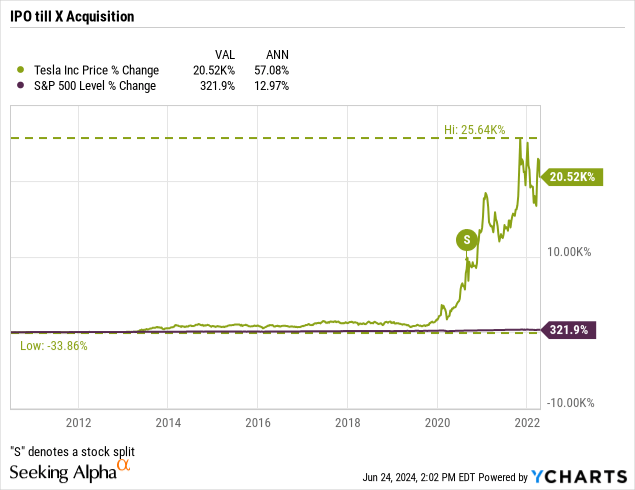

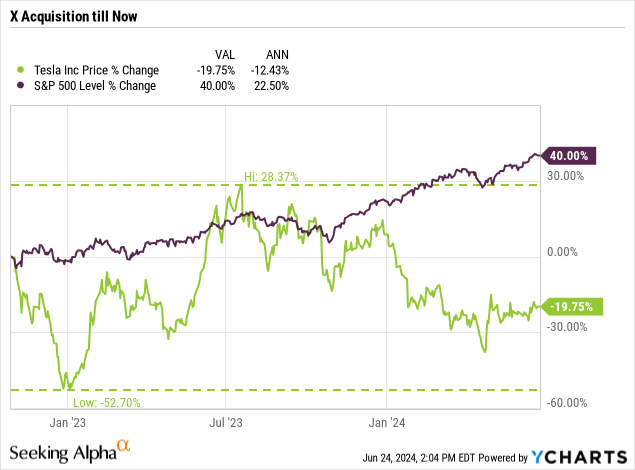

We should look at two performance periods:

- TSLA IPO until the acquisition of X; 6/29/2010 – 4/14/2022

- Post acquisition of X; 8/22/2022 – present.

Note: for this comparison, I am excluding the dates during the acquisition.

Note that this comparison is between two very different time spans and world circumstances. I believe it still warrants inspection.

To be clear, there is more at play than just Musk when it comes to these two stretches of time. I don’t know if we can say Tesla’s recent under-performance of the broader market is due to his action/inaction or not. That being said, should Tesla shareholders want his reign to continue?

Are There Other Options?

Musk has proven himself over and over when it comes to growing small ventures in odd niches into massive corporations. He has been a pioneer in many fields, such as electric vehicles with Tesla, bio-sciences with Neuralink, private aerospace ventures with SpaceX, and even going back to his early days as a founder of digital financial giant PayPal Inc. (PYPL).

What Musk has recently seemed to struggle to do is run all of these maturing giants as efficiently as he grew them. His attention frequently moves onto new things, and now that he is more focused on robotics and AI over elective vehicle and solar technology manufacturing, he is demanding more control to garner his attention.

That attention is easily lost to the next small venture in a niche field that Musk fancies. I believe in his ability to continue to push new boundaries with his corporate endeavors, and that is speaking strictly as an observer.

That means eventually moving on from Tesla as it matures, and he begins to work at what he does best: growing businesses in niche sectors that interest him.

There are other great candidates that have relevant experience who could steer Tesla’s operations alongside Musk if he steps back from the role and continues on as a key shareholder and board member. Back in 2022, Musk endorsed several people as potential successors.

That should act as an immediate short list for the board, with candidates from outside also being considered should they fit well with the board’s idea of what the next CEO will need in terms of skillets.

The Musk Premium, A.K.A. “Valuation”

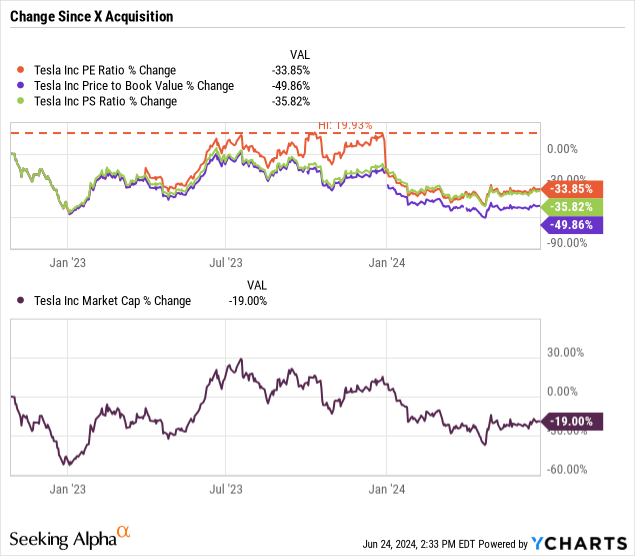

Tesla, regardless of what it chooses to do, whether it tries to fight in the Delaware courts for this pay package and potentially subsequent ones needed to cede further control of Tesla to Musk, or whether it decides to pursue a replacement as CEO, is still valued very heavily by the market. I believe that the market has a lot of interest in Tesla outside of Musk, and that it no longer holds the “Musk premium” that it held before the X acquisition.

Tesla’s under-performance since 2022, in my opinion, is a response from the market to Musk’s increased X activity and increasing distance from Tesla’s ventures as he began to spend more time on his other ventures.

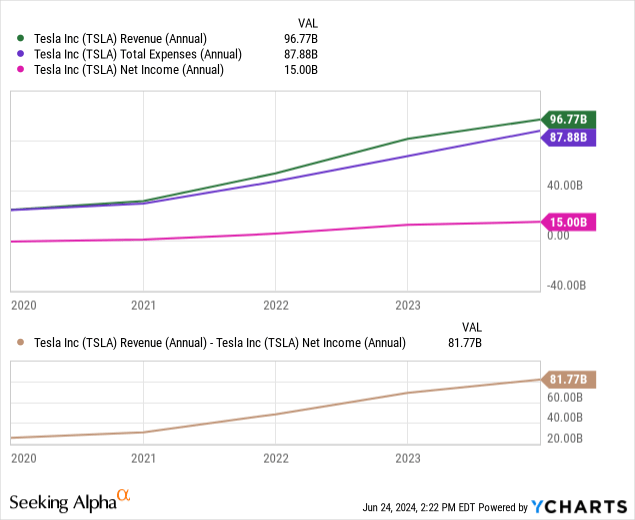

The stock itself has fallen in price rations across the board, which bodes well for investors wanting “cheaper” shares. The stock’s market cap hasn’t fallen nearly as much as these ratios have, showing us an increase relative to the price decline. This means that now the stock is cheaper and earning more per your investment dollar. That signals to me the reduction of some form of premia.

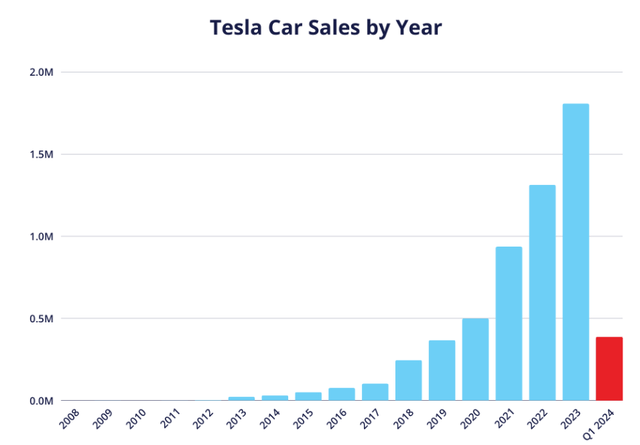

This comes at a time when sales are up, and so is revenue. Despite this, Tesla let go a significant portion of its staff, with continuous rounds of layoffs across departments last month.

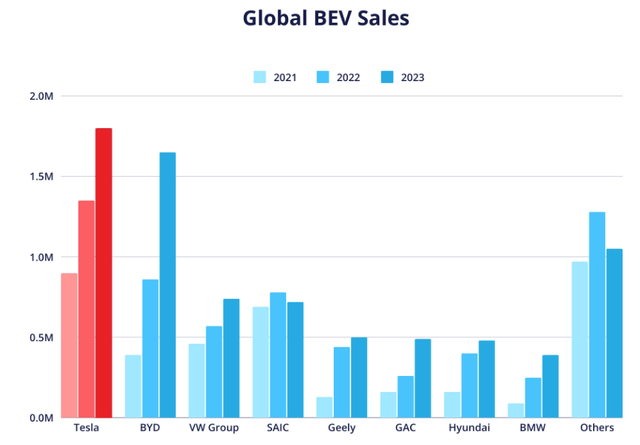

They are even still the leader in sales of battery electric vehicles (“BEV”) in the world, despite Chinese manufacturer BYD (OTCPK:BYDDY) quickly catching up last year.

The growth story is still intact, or at least it should be with these kinds of figures, but the stock is still getting cheaper.

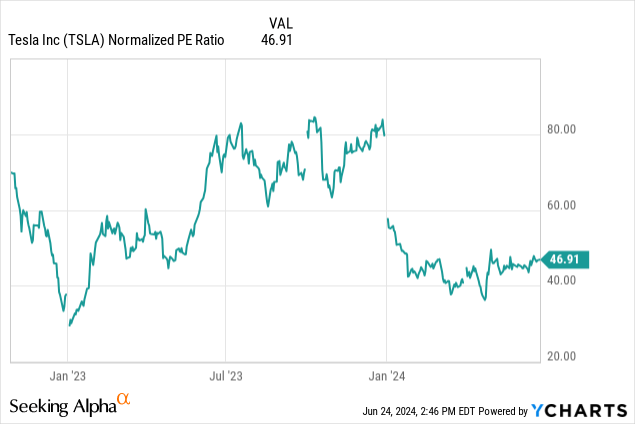

The Premium Isn’t All Gone

There may still exist some level of “Musk premium” still in the stock, as it trades above the market average still when it comes to price-to-earnings ratios, both current, trailing, and forward. Expect that Tesla could get a significant and sudden hit to its stock price if Elon Musk resigns as CEO. His name has become synonymous with Tesla colloquially, and it would be a large blow to his fan base, and, to many investors who tie him to Tesla’s growth story and narrative.

I do not believe that a Musk resignation and stepping back onto the board would harm the stock long term, as he would likely still be heavily involved in Tesla’s on-goings even with a new CEO taking charge, and I believe that the company can stand on its own without Musk should it need to. There are plenty of very competent folks that could step up without issue.

It is still a risk to consider for those reading this article with a bullish lens, as the news could shock the stock in the short term and harm derivative positions like options.

Conclusion

Tesla, Inc. has dropped in valuation and under-performed the broader market in the past two years, since CEO Elon Musk acquired Twitter, now X. Now, Musk is asking for more control of the company, and to dilute shareholders with history-making compensation packages, to continue his reign as “Technoking” of Tesla. Shareholders have other options, and I believe that the Musk premium that used to cause Tesla to trade far above its fair value has lessened. While this may be a buying opportunity for long-term believers in Tesla’s business model, it is unclear where Tesla will go from here, as they may have a lengthy court battle in Delaware ahead of them and Musk has other projects he could be attending to.

That being said, I am giving Tesla a “hold,” as it is now more attractive for buyers than it has been in the past, but it is not attractive enough for me to recommend buying. I am not selling any of my Tesla position, and recommend that other shareholders watch carefully for what comes next of both the trial and the next earnings call next month.

Thanks for reading.