Sundry Photography

Investment Thesis

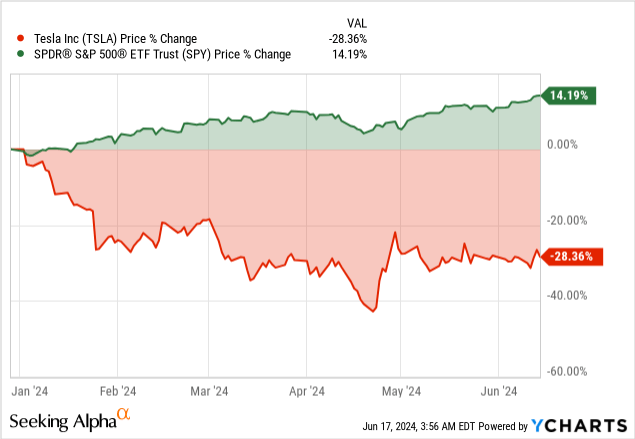

Tesla, Inc. (NASDAQ:TSLA) has been under immense pressure recently. The stock has already decreased by about 28% for the year, while the S&P 500 has gained more than 14%. The underperformance comes amid growing concerns that higher interest rates pressure the company’s premium cars.

Since our last coverage last quarter, Tesla’s stock has entered a consolidation phase, trading sideways. This allows the market to digest its outlook and provides a strategic opportunity for long-term investors to accumulate shares. Technical indicators show positive signs of impending bullish momentum.

Finally, despite recent manufacturing and delivery setbacks, Tesla remains focused on growth and industry dominance. Key strategies include price cuts to make vehicles more affordable, ramping production of new budget-friendly models, and enhancing in-house battery production to reduce costs. Cost-efficiency programs, including staff reductions, aim to lower operating expenditures and sustain competitive pricing.

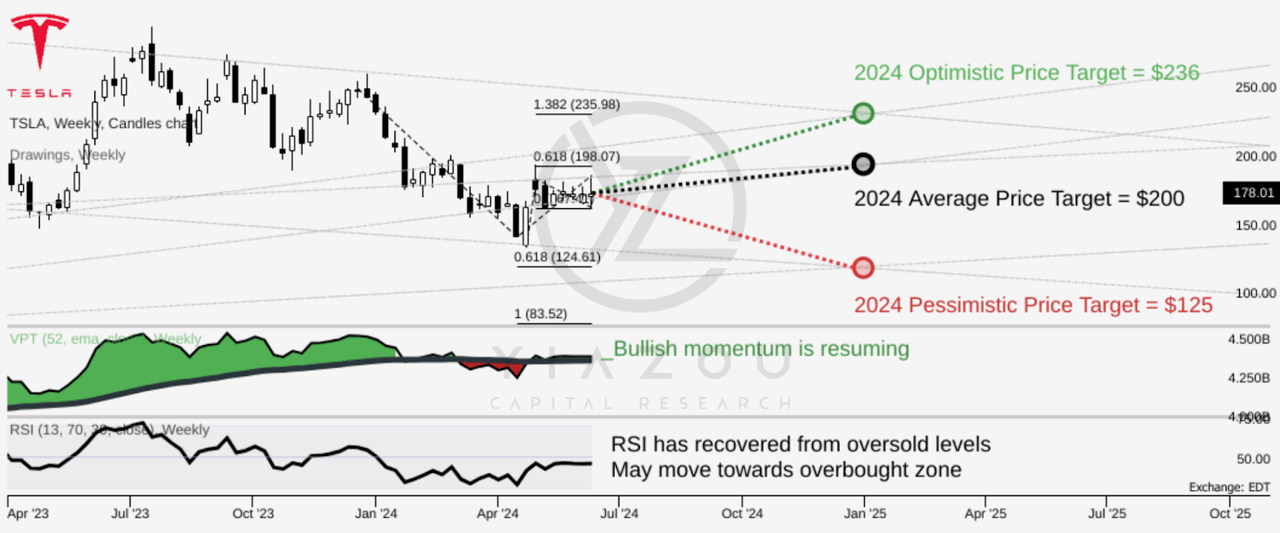

Bearish $125 Low or Bullish $236 High for 2024 Amid Renewed Momentum

TSLA has experienced several shifts in price range consolidations over the medium term. Following the Fibonacci retracement and extension levels, the lower-low price trend derives $125 as a pessimistic price target for 2024. Similarly, the change in the polarity price trend leads to a price target of $200 by the end of this year (on an average basis). On the upside, the price may reach $236 in 2024, derived from a lower-high price trend in line with the 1.382 Fibonacci extension.

Interestingly, bullish momentum is resuming in the stock price, as observed in the volume price trend (VPT). The continuation of the momentum, moving forward, may bring higher-high price moves towards the average or optimistic price target. Observing the alignment of the VPT line’s emergence above the annual average line with the relative strength index’s (RSI) recovery from oversold levels points to the potential for a high upside in the stock price. The RSI line’s progression towards 50 solidifies the assumptions of the technical bullish outlook.

Delivery Drop and Revenue Slump Despite Price Cuts and Expansion Efforts

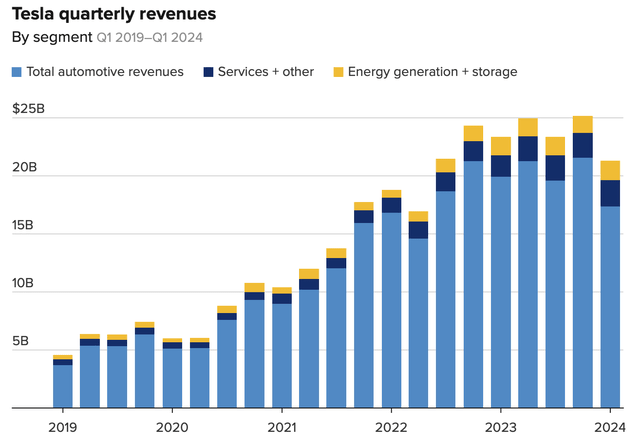

Despite the company initiating significant price cuts, vehicle deliveries were down by about 8.5% to 387,000 cars in the first quarter, marking the first decline since 2020. This also marked a 20% slide from the record 484,507 cars the company delivered for the December quarter.

While the automaker attributed the decline to a temporary shutdown of a German factory following power outages and supply bottlenecks, the market could hear none of it, opting to push the stock lower. CEO Elon Musk has warned that vehicle delivery growth rates will be notably lower in 2023 and only improve on central banks cutting interest rates. Amid the disappointing delivery numbers, Tesla reported a 9% drop in first-quarter revenue to $21.3 billion, falling short of analysts’ expectations.

The drop was even steeper than when the company’s operations were affected by the COVID-19 pandemic. Automotive revenues were down by 13% to $17.38 billion, with net income dropping 55% yearly to $1.13 billion or 34 cents a share, below consensus estimates of 51 cents a share.

The year-over-year decline in earnings came as Tesla reiterated that it is under pressure as many carmakers prioritize hybrids over EVs. To stem a further drop in revenues and profits, the company is increasing awareness and expanding vehicle financing programs, offering attractive leasing terms for customers.

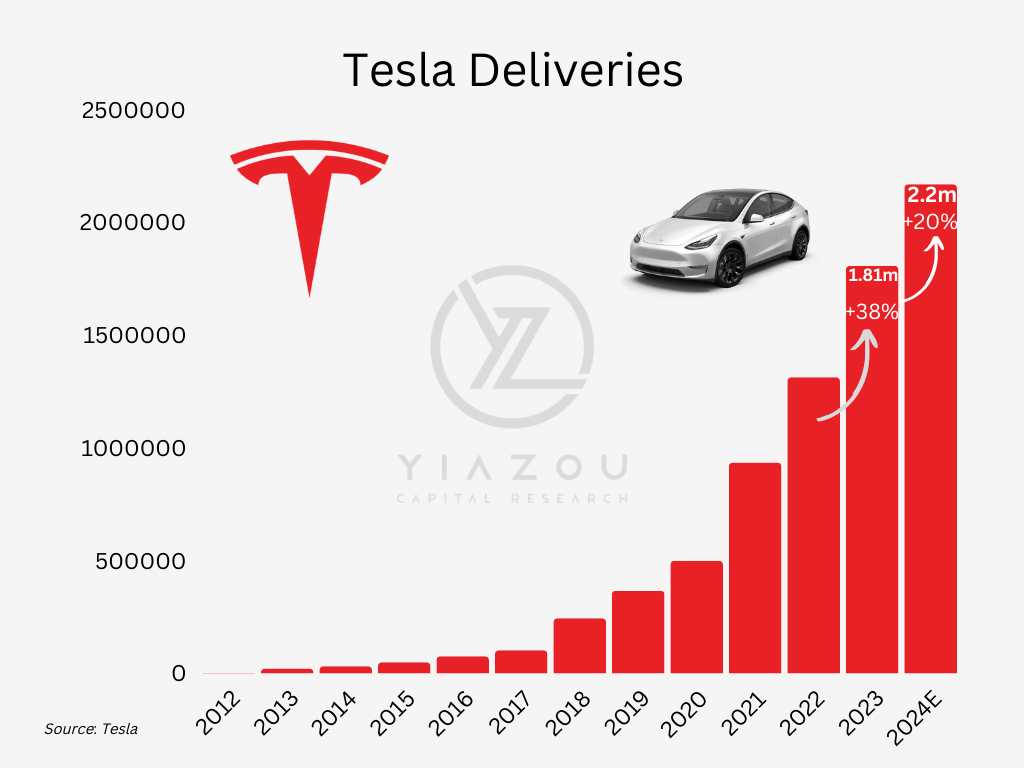

Tesla sold over 1.8 million electric vehicles in 2023, more than 80 times the 22,400 cars it shipped in 2013. The monster growth in deliveries supported tremendous revenue gains, allowing the company to generate significant profit and value for shareholders. Likewise, the massive deliveries underlined how the automaker is the go-to company for electric vehicles as it continues to refine its autonomous driving technology with AI.

Author

Tesla Slashes Prices and Capitalizes on Lower Input Costs to Supercharge EV Market Dominance

Amid the recent setbacks in manufacturing and deliveries, the electric vehicle giant remains focused on dominating the automotive industry. While it produced 1.8 million cars last year, this is only a tiny fraction of the industry’s total. For instance, over 90 million cars were produced annually across the auto industry last year.

Similarly, the transition towards electric vehicles as one of the ways of combating carbon emissions and climate change presents tremendous opportunity given the head start that Tesla already enjoys. While delivery numbers fell in the first quarter for the first time in nearly three years, Tesla is not resting as it looks to sell over 20 million electric cars by 2030. The automaker is resorting to price cuts as one of the ways of making its car affordable to try and push out more sales.

Additionally, Tesla has already announced plans to speed up the introduction of new models, including more budget-friendly options that will be manufactured on the same production lines as existing models. It intends to optimize its existing production capabilities before constructing new production facilities.

Making vehicles more affordable would motivate new buyers, particularly those put off by the premium price. Ultimately, the automaker should benefit from economies of scale, which would help it reduce the cost of making each car, thereby enabling it to decrease its prices further.

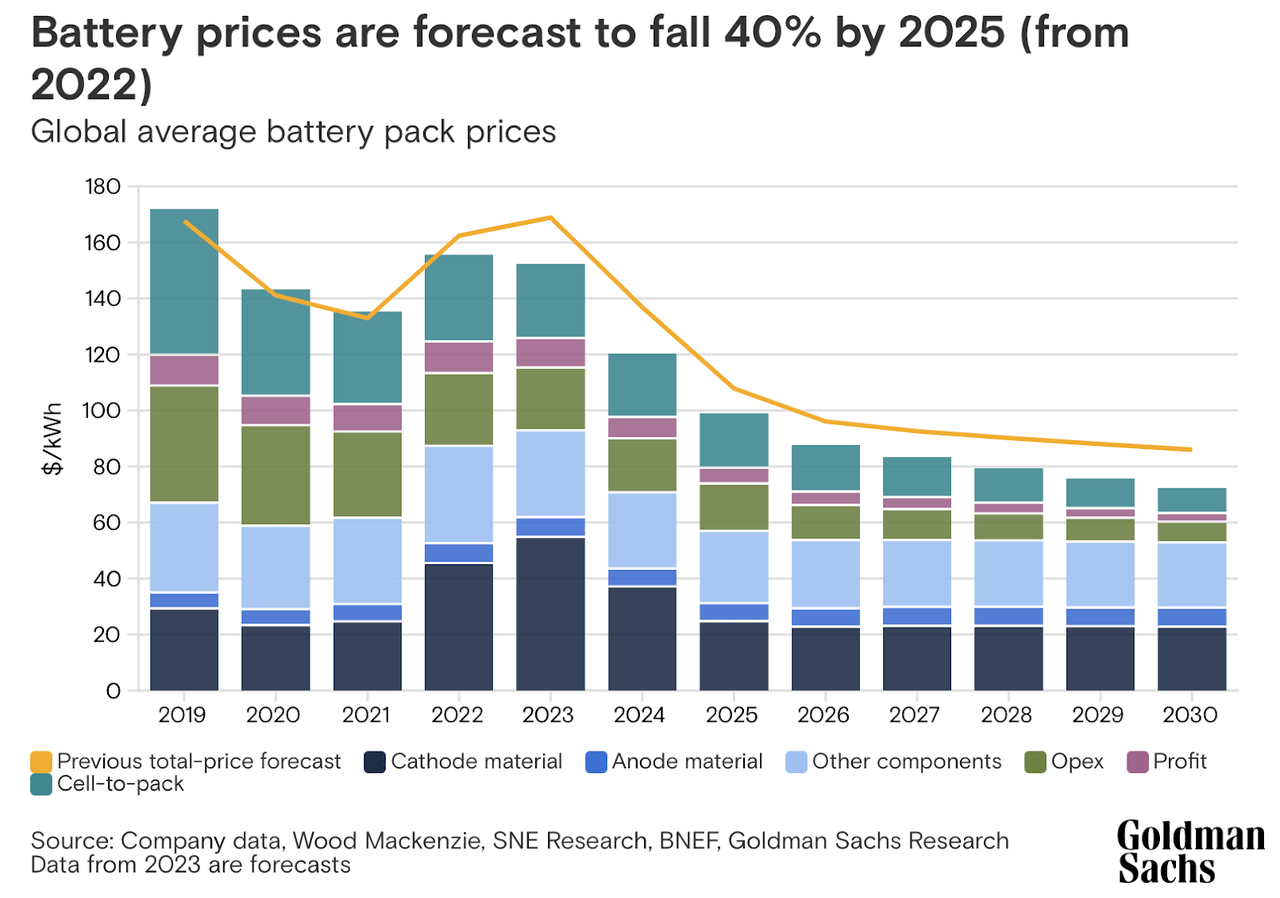

While there have been growing concerns that price cuts’ are taking a significant toll on profits and margins, there is an upside. The cost of goods sold is declining, driven mainly by lower raw material costs, consequently justifying the price cuts. For instance, lithium prices declined throughout 2023 and remained subdued for the rest of the year’s first half. Battery metals, also a key ingredient in Tesla vehicles, have declined significantly across global markets, with Goldman Sachs reiterating that the cost will decline by up to 40% by 2025.

Additionally, it has embarked on a cost-efficiency program that includes laying off at least 10% of its staff. Reducing operating expenditure is expected to result in lower goods sold per vehicle costs, allowing the automaker to sustain price cuts for EVs to drive more sales.

While price cuts are crucial in driving more sales, the company is also doing more on the production front as it looks to offer more options in electric vehicles that people can buy. In addition, it is ramping up production of batteries in-house, which should improve the overall profitability by making the cars less expensive and affordable for the mass market.

Tesla’s Billion-Dollar Bet: AI-Powered Self-Driving Tech and Ride-Sharing Revolution

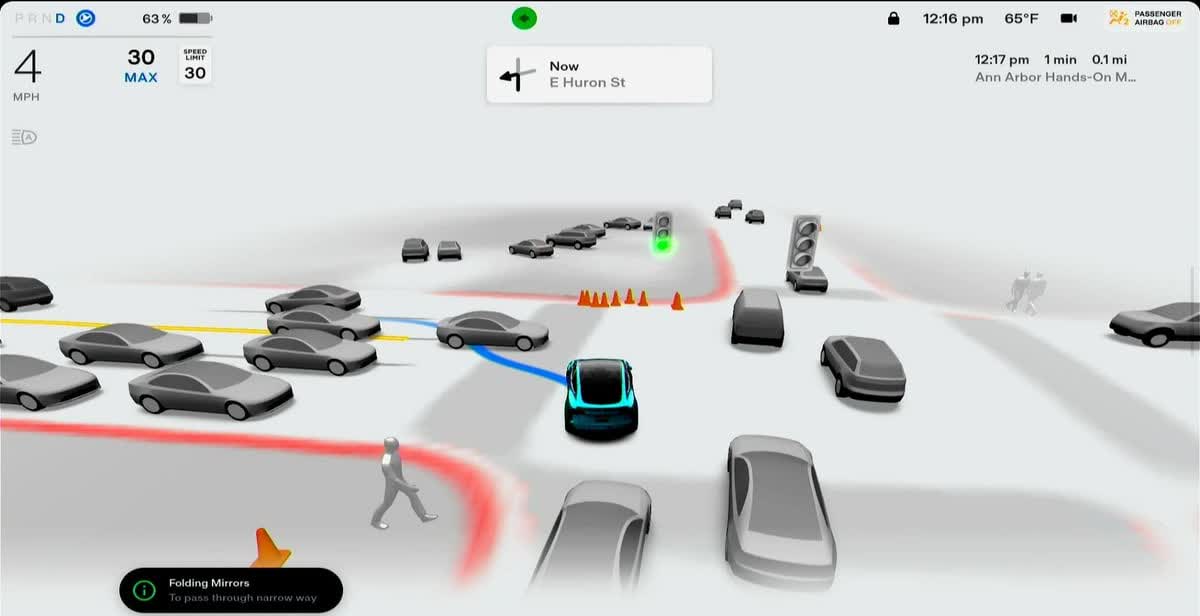

Even as Tesla boosts production and offers discounts on juice sales, it pours much into its self-driving technology, which will define its prospects for the long term. It has already spent $1 billion in CapEx on AI infrastructure as it continues to polish its software and hardware to create self-driving cars and ride-sharing services.

With a clear plan and a complete AI network trained on trillions of miles of actual driving data, the company can grow and make money in self-driving technology. Tesla’s offering of Full Self-Driving (FSD) subscriptions to its clients is expected to create a steady income stream with a high profit margin. In April, the automaker reduced the cost of its FSD subscription in the U.S. from $199 to $99 monthly. For those who purchased the Advanced Autopilot package for $6,000, Tesla provided a more affordable FSD subscription at $99 rather than the original $199.

Additionally, Elon Musk has proposed allowing other car companies to use FSD, opening up a new source of income. Software development is a one-time investment whose products can be sold many times over; thus, it’s an ultra-profitable venture. Musk also sees a Tesla ride-sharing project. He has observed that most privately owned cars are usually used only for 12 hours a week; they are stationed in front of the owner’s home or office for most of their lives. FSD will allow the owner to rent their car to Tesla’s ride-sharing service, making some extra money while it’s not in use. Tesla will receive a portion of this income to oversee the service.

Tesla continues to innovate, with FSD Beta version 11, featuring a unified tech stack for city and highway Autopilot use, which is expected to be released widely soon. This phased rollout, starting with employees and expanding to more owners, ensures continuous improvement and refinement.

notateslaapp.com

Tesla Faces Challenges Amid Delivery Slowdown and Price Cuts, Yet AI Investments Fuel Long-Term Optimism

A slowdown in vehicle deliveries and revenue growth rate in the first quarter is an emerging concern that continues to rattle Tesla stock sentiments in the market. The fact that Tesla slashed prices by up to 25% last year to support demand could be an early indicator of softening demand across the EV industry.

Elon Musk has already warned that sales could be lower in 2024 owing to the high interest rate environment. Likewise, Ford Motor (F) and General Motors (GM) have already slashed their investments in electrification plans, indicating things are not good in the industry.

Growing competition is another significant risk that Tesla investors must contend with. China-based automakers developing affordable electric vehicles should continue putting pressure on Tesla, forcing it to issue more price cuts to attract sales. However, price cuts are not a sustainable long-term plan for Tesla to remain profitable.

Cathie Wood Predicts Tesla’s AI-Driven Surge to $2,600 by 2029 with Robotaxi Revolution

Ark Investment CEO Cathie Wood has already reiterated that Tesla remains the most significant AI opportunity in the auto industry, given its investments. The company is racing to develop the industry’s most advanced autonomous driving software, which sets it apart from the pack.

According to Cathie Wood, Tesla shares will hit record highs of $2,600 by 2029, representing a 1350% gain from current levels and achieving an enterprise value of $8.2 trillion. The rally will come on the automaker achieving profits of $300 billion, representing annual gains of 90% through 2029, and on revenues of more than $1.2 trillion, representing a yearly gain of 65%.

The ambitious estimates are based on growing expectations that Tesla will launch a robo-taxi business that will be significant and help drive revenue growth. Wood expects Tesla to succeed in competing against Uber in the ride-sharing business. Lastly, automakers are expected to raise production by 45% every year.

Bottom Line

If the 28% plus slide is anything to go by, Tesla has undoubtedly underperformed for the better part of the year. The company has paid a hefty price for decelerating in-car deliveries, compounded by revenues and missed earnings in the first quarter. Amid the disappointment, the company has continued to fire on the execution front as it positions itself as a low-cost car producer.

Investments in AI are poised to enhance the company’s self-driving technology, making its cars desirable and competitive in the market. As the company explores ways of trimming manufacturing costs, reducing prices, and selling more cars, its profit margins should improve. The recent pullback presents an ideal entry point for anyone looking to bet on Tesla’s solid growth and long-term prospects.