ozgurdonmaz

AAPL stock enters the AI future

The current excitement surrounding Apple Inc. (NASDAQ:AAPL) stock is largely due to its recent WWDC conference. The excitement is definitely in order and well-deserved. The WWDC24 conference showcased AAPL’s strategy for both software and hardware towards the AI future – whether you interpret it as Artificial intelligence or Apple intelligence.

With its enviable installed base of 2.2 billion active devices, AAPL is best positioned, in my view, among the major tech firms to capitalize on these upgrades. Even before the explosion of AI, the company had accumulated well over one billion paid subscriptions, having more than doubled over the last four years. This sets the stage for continued growth in higher-margin services revenues, as the breadth and quality of Apple’s offerings continue to expand with its AI upgrades.

Since the potential impacts of the WWDC have been detailed by many other authors already, I do not want further to add onto this front here anymore. My goal in this article is to argue for a bullish thesis from an angle less often discussed – how AAPL’s unique strength enables it to short fiat money at a large scale and how it benefits shareholders like you and me.

The best type of investment

First, allow me to digress and share my ideas of the best type of investment. In my mind, the best investment idea is to use fiat money (such as the U.S. dollar) to buy a resource that gets more and more scarce. Good examples include fine arts, collectible antiques, and land in major metropolitan areas. However, these ideas are inaccessible to most people. Therefore, most of us settle for the second-best idea, which is to use fiat money to buy a resource whose supply does not expand as fast as fiat money.

The shares of good companies and good are good examples here, as illustrated by the two charts below. In the past 20 years, SP500 delivered a total return of 446%, pretty impressive. But at the same time, the total money M3 supply expanded by 230%. As a result, the real return of SP500 relative to M3 supply is “only” 65%. It is not as impressive as it seems on the surface, but it still helps shareholders to get a larger piece of all the money printed. Gold paints the same picture as illustrated by the second chart below, delivering a total return of 57% in the past 20 years relative to M3 supply. It is very close to that of the SP500. Gold is a good investment, not because it has become more and more scarce. We mine more and more gold every year. It is just that we have not learned to increase our gold supply at a faster pace than the M3 supply (yet).

The essence of both the best and second-best ideas is the same: it is the use of an alternative asset (art, land, gold, SP500) as a way to short fiat money. And in my mind, this is the surest way to invest in the long term. With this digression, let me get back to AAPL now. Next, I will argue that its shares are a resource that is getting more and more scarce thanks to the large share repurchase.

Source: inflationchart.com Source: inflationchart.com

AAPL stock: how it shorts fiat money

AAPL’s share prices appreciated more than 800% in the past 10 years alone, far outpacing the M3 supply growth in this period. Looking ahead, I certainly do not expect such spectacular returns in the years to come. However, you will see from my analysis below why I expect it to keep outperforming the broader market by a large margin and the M3 supply.

AAPL now trades at about 33x forward P/E ratio, as illustrated by the chart above. As explained in my earlier article:

To me, any P/E near 30x is very attractive for a stock with ROCE (return on capital employed) near 100% like AAPL. At about 100% ROCE, a 5% investment rate would provide 5% organic real growth rates (i.e., before inflation adjustments). Adding an inflation escalator of 2% would push the nominal growth rate to 7%. And a ~30x P/E would at least (because its owner’s earnings are higher than its accounting earnings) provide 3% of earnings yield in AAPL’s case, leading to a total return in the double digits.

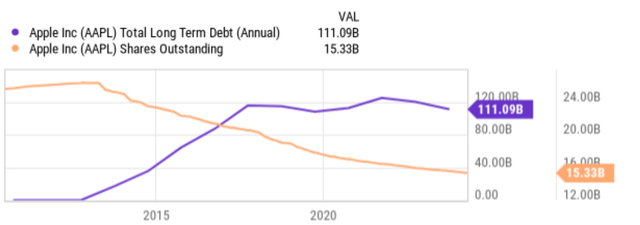

A double-digit annual return already provides good odds of beating both the SP500 and M3 supply in my mind. But it gets better thanks to its share repurchase program. You must already know that AAPL has been buying back its shares at a large scale recently (see the next chart below) and it has recently authorized an additional program to buy back $110 billion of stock (the largest in the company’s history). Stocks in well-established companies are attractive to start with because their share issuance is limited – that is why SP500 is a good investment idea. In AAPL’s case, the situation is even better. As the overall money supply increases, its share counts shrink. By owning a piece of a company with consistent growth and decreasing share counts, we can potentially win twice.

Actually, we can win three times, as AAPL is also in a position to enjoy some of the best borrowing rates and can effectively use borrowed money to buy its shares. And I stand corrected for the best investment idea mentioned in the earlier section. The best investment idea is NOT buying a resource that gets more and more scarce. It is buying them with borrowed fiat money (and repaying the money later with diluted currency or, even better, refinancing it).

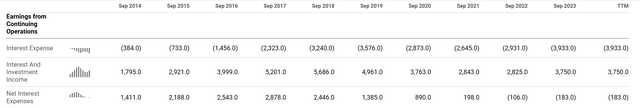

My teenage son has reached a stage of interest in investing and finances. As a loyal Apple fan, he asked plenty of good questions (and dumb ones too) surrounding the stock. One of his more intelligent questions is – if AAPL makes so much money, why does it have so much debt (see the next chart below)? My answers are twofold. First, it is a privilege – not a lack of money – to borrow on the terms that AAPL enjoys. As illustrated by the chart below, the company paid about $3.7B of interest expenses in 2023. With a total debt of $111B, the effective borrowing rates are only 3.3%. Second, when you can generate returns higher than borrowed money, you want to borrow as much for as long as you can. Indeed, a good portion of APPL’s debts won’t mature in years or even decades later. The spread between the double-digit return potential as aforementioned and the 3.3% borrowing rates – at a scale of hundreds of billions and for many years – is an advantage too large to ignore.

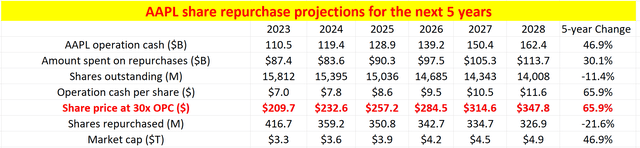

AAPL stock: the overpowered double compounding

Finally, as an illustration of the potency of the above ideas, the table below shows my projected impact of what I call double-compounding – the combined effect of growing profitability and shrinking share base. My analyses were based on simple assumptions. First, I assumed AAPL to allocate about 70% of its operating cash flow (“OPC”) toward share repurchases, estimated from its announced repurchase plans and OPC recently. Second, I assumed its OPC to grow at an 8% annual rate according to consensus EPS estimates. Lastly, I also assumed the repurchases to be made at a price that equals 30x of its OPC, which is the current multiple. You can tweak these assumptions to make different projections, of course, but I think the example here is sufficient to illustrate the essence of the fundamental forces at work.

Under these assumptions, the projection points to another 11.4% reduction in its share in the next 5 years. AAPL shareholders like myself would own 11.4% of this wonderful business without doing anything (and enjoying a 66% share price appreciation along the way).

Risks and final thoughts

I don’t see any structural risks particular to AAPL. AAPL shares the common risks facing its peers in the tech sector. A slowing economic growth could dampen consumer spending on electronics and delay their upgrade schedule. Scrutiny from regulators over issues like data privacy and antitrust is a potential risk.

Besides these macroeconomic risks, Apple also faces some logistical and geopolitical risks. Its heavy reliance on a limited number of contract manufacturers, primarily located in Asia, can make it vulnerable to supply chain disruptions caused by geopolitical tensions or natural disasters. As a notable recent example, the company encountered supply constraints for the iPhone 14 Pro and 14 Pro Max due to factory shutdowns amid the COVID-19 pandemic. Its iPhone sales in China, one of its key markets, also face some uncertainties due to competition from local brands and potential restrictions from the government.

All told, my verdict is that the upside potential far outweighs the downside risks under current conditions, making the stock a strong buy both in the short-term and long term. In the near term, I anticipate the AI upgrade cycle to be the dominating force. In the longer term, I see a very skewed return/risk profile for Apple Inc. stock due to the double-compounding from growth and share repurchases (or even triple-compounding if cheap borrowing is also considered).