Richard Drury

TSLA stock has an inventory buildup

For the analysis of growth stocks like Tesla, Inc. (NASDAQ:TSLA), I kept going back to timeless insights from Peter Lynch. One key insight I learned from Lynch involves the following use of inventory data:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch also explained why inventory levels can be a telltale sign of business cycles. Especially for cyclical businesses, inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory could be an early sign of a recovery.

Against this background, the thesis of this article is to argue that Tesla is now showing the sign of an inventory buildup. Due to such buildup, the company’s growth trajectory and valuation multiples (the stock currently trades at 67x P/E) have now come into question.

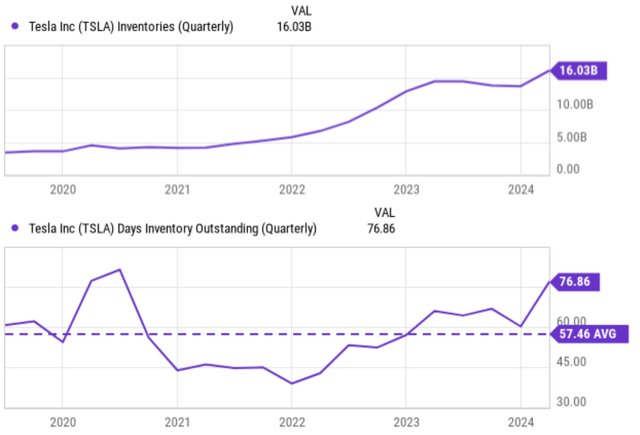

Let’s start with the data. The chart below displays TSLA’s inventory in dollar amount (the top panel) and in days of inventory outstanding (DOJO, the bottom panel). As you can see from the top panel, Tesla’s inventory in absolute dollar amount has significantly increased since in the past. In the past 3 years alone since 2021, the inventory level climbed from about $5 billion to the current record level of over $16 billion. Of course, there is nothing wrong with a growing inventory as the business grows – as long as the sales grow in tandem. However, this is unfortunately not the case, at least not the case since early 2024.

As seen in the bottom panel, Tesla’s DOJO now also sits at a record level of about 77 days. Before 2024, the DOJO remained close to its average of 57 days. The exception was the period in 2020 amid the COVID-19 breakout. That buildup was largely caused by the global logistic network, not the softened demand for its cars.

Next, I will explain why the build-up this time is caused by softening demand.

TSLA stock: where is the inventory and why it builds up

A visual display of the inventory probably can better help to illustrate the scale of the issue. According to Sherwood News, Tesla has been stacking these unsold cars in parking lots to store them, and they can even be seen from space as shown in the picture below as an example. The top panel shows the status of the parking lot of Tesla’s Gigafactory in Austin, Texas in October 2023, and the bottom panel shows the status in March 2024. You can see the lots that were almost full in 2023 remain as of Mar 2024. But two more lots, those two outlined in green in the images, have become much fuller now.

Regarding the cause of such a buildup, TSLA’s Chief Financial Officer Vaibhav Taneja recently commented:

The primary driver of this was an increase in inventory from a mismatch between builds… We expect the inventory built to reverse in the second quarter and free cash flow to return to positive again.

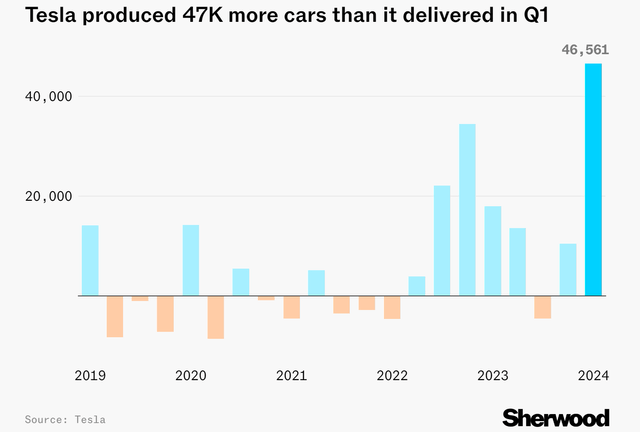

Indeed, in the past quarter, the company produced over 433k cars and only delivered about 386k. As a result, a total of ~47k cars now sits in the inventory (see the next chart below). Such a large inventory buildup ties up cash and creates balance sheet risks. The company reported a negative $2.5 billion in free cash flow in the past quarter. And it could start a negative feedback loop as lack of free cash and more risky balance sheet could restrict the company’s capital allocation flexibility to pursue growth.

Finally, I am skeptical regarding its CFO’s confidence for the inventory buildup to reverse in the next quarter. I see the buildup as a more persisting issue that could last longer. A main factor for my skepticism is the broader EV overcapacity issue, especially from Chinese producers. As pointed out by a recent Nikkei Asia report,

Electric vehicle production capacity in China continues to expand at breakneck speed despite being vastly larger than domestic demand, fanning fears that manufacturers will export vehicles abroad at cut-throat discounts. The break-even point for factory utilization in the automotive industry is usually around 80%, but the level for new energy vehicles, which includes EVs, is only around 50% in China. Several emerging EV makers have already gone bankrupt due to overcapacity in the industry.

TSLA stock: valuation difficult to justify with current growth potential

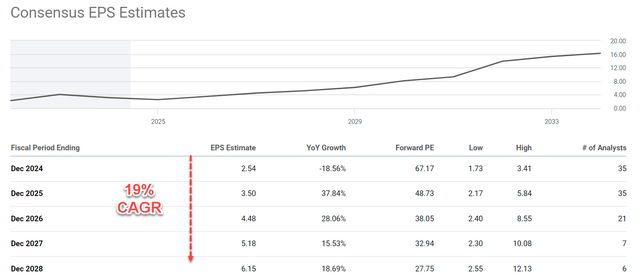

Given the above inventory data, I expect its volume growth to fall short of the ~30%+ increase in deliveries recorded recently. Such a slowed growth outlook also brings its premium valuation into question. Moreover, due to increased competition, lower selling prices, higher operating expenses, etc., I anticipate the growth rates in its bottom line to be even lower. The next chart shows the consensus EPS estimates for TSLA stock in the next 5 years.

To wit, analysts expect TSLA’s EPS to decline substantially in the next year. Its EPS is projected to decline by 18.56% to $2.54 in FY 2024. After that, its EPS is expected to recover. All told, the EPS is expected to grow at a compound annual growth rate (“CAGR”) of 19% in the next 5 years. TSLA currently trades at over 67x of its FY1 EPS. Even if – a big IF in my mind given the broader overcapacity issue as aforementioned – the 19% projected growth rate actually materializes, the implied PEG (P/E growth ratio) is still over 3.5x, far higher than the 1x gold standard growth investors look for.

Other risks and final thoughts

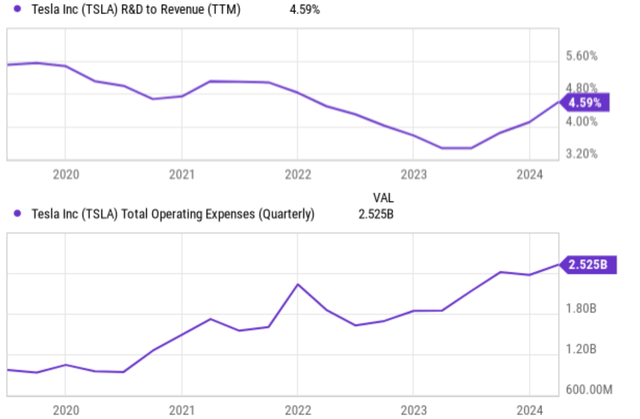

Besides the issues mentioned above, there are a few other risks, both in the upside and downside directions, which are worth mentioning before I close. As a high-tech growth company, TSLA’s also needs to ramp up its R&D projects to stay ahead of the curve. The company currently spends about 4.6% of its revenues on R&D (see the top panel of the chart below), which is not enough in my view either compared to its own historical average or to other high-tech companies. The FAAMG group on average spend about 10% of revenues on R&D.

The company also needs to effectively control its operating expenses, which have been increasing rapidly in recent quarters (see the bottom chart below). The company has some cost-control plans to improve operational efficiency and reduce costs per vehicle. But the effectiveness remains to be seen amid the pressure of high labor cost, material cost, and energy cost.

On the positive side, the Cybertruck production ramp may provide a new growth front (although the investment here could weigh on the bottom line in the near term). Besides its EVs, Tesla also invests in other areas and new products such as its charger network, robotics, and autonomous driving technology, which all have potential for high growth. As a notable example, it recently reported that its driver-assistance system was tentatively approved in China.

All told, I see a mixed picture facing TSLA stock and thus rate it as a HOLD under current conditions. To reiterate, TSLA is still the leader in the EV space, a sector I anticipate enjoying secular growth for years or even decades to come. It offers many competitive advantages ranging from scale, brand recognition, effective vertical integration, etc. However, over the next 1~2 years, I see strong growth headwinds for Tesla, Inc., and I see its current inventory buildup as a clear reflection of these headwinds.