Klaus Vedfelt/DigitalVision via Getty Images

Tesla, Inc. (NASDAQ:TSLA) will announce its financial results for the first quarter of 2024 post-market on Tuesday, April 23, and this article reviews the indicators that I’ll be watching heading into this important day that may lead to a reversal in the stock price.

I last reviewed Tesla in my article titled, “Tesla: Here’s Why It’s Down 24%,” in which I presented the various ways Tesla discounts its cars and discussed the rapid decline in the resale value of its vehicles. This article is a follow-up to the data presented in my previous article, so I recommend that you read both.

Tesla Resale Value Declines Continue

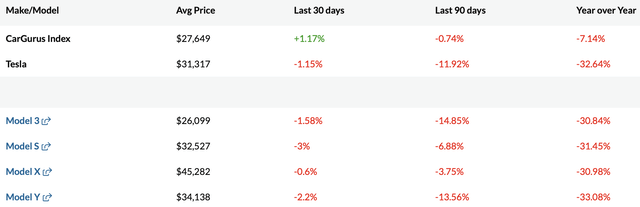

The following from CarGurus presents the latest data on Tesla’s resale values:

Since my most recent article nearly two months ago, the average price of a used Model 3 listed on CarGurus sank from $27,429 to $26,099, or by 5 percent. Similarly, used Model Y average prices dropped from $35,996 to $34,138, also by 5 percent in the same period. The resale values of the Model S and X show similar trends. With Tesla’s recent round of price cuts announced over the last few days in all of its key markets, including the U.S., China, and Europe, I expect the resale value declines to continue in the foreseeable future.

Importantly, however, the pace at which Tesla’s resale values are declining, has slowed down: I showed in my previous article that the resale values of the Model 3 and the Model Y had declined by 8.1 percent and 6.6 percent in the preceding 30-day period, respectively. The above table shows that the pace of decline in the most recent 30-day period was 3 to 4 times slower.

Do Not Jump To Conclusions

Although this recent development is a glimmer of hope for Tesla investors, I caution readers from jumping to conclusions, as there are multiple factors that act on Tesla’s resale values at any given time.

First, seasonality is a strong factor during the months of March and April, coming out of winter months and as buyers may be using their tax refunds for a down payment towards purchasing a new or used vehicle, driving demand up temporarily. In fact, the recent data also supports this theory: CarGurus Index in the above table increased by 1.17 percent in the last 30 days, in contrast to the 0.69 percent drop in the 30-day period ending March 5, as I showed in my previous article, indicating that seasonality trends could explain a material part of the slowdown in the pace of Tesla’s resale value declines.

Second, Tesla increased its prices for the Model Y on April 1 by $1,000 in the United States; therefore, some potential Tesla buyers may have shifted from buying a new Model Y to instead opting for a used Model Y, supporting used Tesla resale values at the margin. With Tesla’s recent price cuts across the board that are rightfully pressuring the stock in the pre-market this morning, I expect Tesla’s resale values to continue downward throughout the year. If Tesla’s resale value continues downward through the year, I wouldn’t expect the company’s Automotive sales or margins to improve materially at the same time.

What May Improve Sentiment In Tesla Stock

It’s not all doom and gloom for Tesla investors, so let’s look through the items that I will be watching on tomorrow’s earnings release and the following call.

First, the Cybertruck production ramp has been slower than I had hoped, and deliveries were recently halted due to a fix needed for the accelerator pedal. However, despite that, the Cybertruck production has been ramping faster than the original Model 3 production ramp in the second half of 2017: According to the Safety Report by NHTSA, Tesla recalled the 3,878 Cybertrucks it had delivered in the first four months, more than twice as many as the 1,770 Model 3 cars it had delivered in the first six months of that production ramp. I look forward to learning more about the ongoing Cybertruck production ramp tomorrow, as this is an important product that could change the narrative in coming years.

Second, Tesla recently took major pricing and other actions to boost the adoption rate of its full self-driving, or FSD, software that has been the subject of much criticism lately: In late March, Tesla offered a free 30-day FSD trial to new and existing Tesla owners. On April 12, Tesla cut FSD monthly subscription price from $199 to $99 in the U.S. On April 21, Tesla dropped the FSD purchase price from $12,000 to $8,000. Two possible reasons Tesla may have taken these material pricing actions are (1) a cash grab in the short term when the fundamentals of the company appear challenged and/or (2) attempts at increasing the number of disengagement data collected to be used in the training of subsequent versions of the FSD software. I look forward to learning more about the motivations of Tesla’s recent pricing actions tomorrow.

In addition to the above two topics that are of interest to me, any material data or management commentary on the following topics could be important for the purposes of my analysis: Tesla’s own 4680 battery production ramp, stationary storage battery installations and profit margins, compact car production plans, the robotaxi unveil event planned for August 8, plans for potential factories in India and/or Mexico, and the Optimus humanoid project.

Tesla’s Long-Term Story Is Intact

Despite the intense headwinds Tesla is facing in the near term, especially in Automotive deliveries and declining margins and continued declines in resale values indicating further pressure in sales and margins, as well as the recent departures of top-level management talent, I am keeping my eye on the company’s longer-term fundamentals, which, I believe, will be influenced by the progress of the FSD disengagement data, visualized by this crowdsourced tracker, and what that may mean for the development of Optimus and how Tesla’s efforts around artificial intelligence may differentiate Optimus from other humanoids produced by competitors in the future. I see Tesla as an artificial intelligence company, and therefore, my long-term understanding of the company depends more on FSD and Optimus, even though I note that Tesla stock is impacted in the near-term by production and deliveries of the existing vehicle models.

The Bottom Line

With the recent top-level management departures, Tesla, Inc.’s earnings release and the ensuing call tomorrow is set to be an interesting event, but I will be keeping my eye on actual data and material management guidance on the topics that matter to long-term investors, rather than drama. I highlight the recent slowdown in the pace of Tesla’s resale value declines as a glimmer of hope, and I reiterate my Hold rating for the stock. I will analyze incoming data to determine when demand for Tesla’s existing models has bottomed, and will update my followers with a potential rating upgrade in future articles.