jetcityimage

To begin, I must confess that I am an outsider regarding Tesla, Inc. (NASDAQ:TSLA) although I have taken an interest in its products and a beneficial ownership in its stock. I am not partial to any information that the public is not aware of, moreover, I have not memorized the latest delivery figures or the multitude of financial metrics that many analysts know by heart. Still, I did put a Buy rating on Tesla in Jan 2015, warning readers that the stock was a very risky short and, conversely, a great speculative bet. I have also owned a Tesla Model 3 since early 2021 and can say from firsthand experience that Tesla makes a wonderful product. The car has performed flawlessly, except for the occasional low battery that may be quickly addressed through a multitude of Superchargers in my area.

Recently, Tesla rolled out a Full Self-Driving, or FSD (Supervised), 30-Day Trial, giving me an opportunity to test drive the company’s software. As a point of comparison, I had test-driven FSD in mid-2021. Three years ago, I paid for one month’s subscription to the service and chose not to keep it due to its low functionality at that time. The extent of FSD’s utility, back in 2021, was limited to changing lanes while highway driving. This was not a worthy investment for me, particularly given that Autopilot came for free.

For the uninitiated, Tesla’s Autopilot is an advanced driver-assistance feature that allows the car to automatically: steer, accelerate and brake within its lane. In short, Autopilot does an impressive job of highway driving, although the driver must keep their hands on the steering wheel at all times. Living in Los Angeles, I have made much use of this feature. In fact, it was one of the major reasons that I purchased a Tesla. However, my test-drive of FSD at the time added little, and I put the package out of mind for the past three years.

Full Self-Driving (Supervised) 30-Day Trial:

Upon updating my car’s software recently, I was surprised to learn that I was green-lit for another FSD 30-day trial. This announcement came completely out of the blue, with my first instinct being disappointment. Coincidentally, and according to Murphy’s Law, my trial overlapped with two weeks of travel that I had planned months earlier. I was frustrated at first for missing half my trial, but excited at the same time to give it a shot, wondering what had changed that warranted a fresh look. After doing so, I am pleased to report that the latest version of FSD (v12.3.6) thoroughly impressed me.

In fact, the experience was nothing short of remarkable. I began the test drive on a six-lane divided road named West Jefferson Blvd in Playa Vista, California, about 3.5 miles from nearby Playa del Rey Beach. This was the last day before my trip and I wondered if the new version of FSD could handle a short trip with my careful observation, but without any intervention.

From the moment that I engaged the FSD, my Tesla Model 3 required no intervention (save for my hand on the steering wheel) to reach the beach. I traveled down West Jefferson and just before the Ballona Wetlands Ecological Reserve, a light changed from green to yellow and then red. I tensed my foot anticipating that I would need to stop the car, but remarkably, before I could even cover the brake, the car was already slowing to a stop. There was construction ahead and orange cones marking off lanes of traffic and merging the three lanes into a single lane of traffic.

The car navigated this flawlessly, albeit slowing necessarily as a driver to my left did not allow me to merge but instead pulled ahead. My car slowed, found the single remaining lane and proceeded forward to another stop light, navigating a 90-degree turn after waiting for the light to turn green. Merging onto Culver Blvd, it was now a straight shot to the beach where I parked, impressed by the system’s ability to make real-time decisions and looking forward to a pleasant walk by the Pacific Ocean as I contemplated Tesla’s vision of an autonomous future.

The Evolution of Tesla’s FSD:

The journey toward FSD began with the introduction of Autopilot in 2014. Over the years, Tesla has updated its software continuously, enhancing its fleet’s ability to navigate complex driving situations. One striking feature in the latest version is how far FSD has come in three short years. A software that in mid-2021 barely contributed to highway driving has now reached the threshold of autonomous driving on city streets.

This has caught the notice of even Warren Buffett, who spoke of Tesla at a recent Berkshire Hathaway (BRK.A) annual meeting, specifically regarding how this new technology could impact the insurance business:

Anything that reduces accidents is going to reduce [insurance] costs…If it really happens, the figures will show it and our data will show it and our prices will come down. [Specifically about Tesla, Buffett continued] If accidents get reduced 50%, it’s going to be good for society but It’s going to be bad for insurance companies’ volume. But good for society is what we’re looking for.

Thus, in a few short years FSD has gone from having very little impact, to challenging the future revenue of major insurance companies. As Buffett correctly noted, these changes have not shown up in insurance company’s volumes yet, but investors should take note that this outcome is being taken seriously by the smartest investors in the room.

Market Potential and Revenue Streams:

The autonomous vehicle (“AV”) market is expected to grow exponentially in the coming years. According to a report by Fortune Business Insights, the global AV is projected to grow from $1,500.3 billion USD in 2022 to $13,632.4 billion USD by 2030, exhibiting a CAGR of 32.3%. A number of entrants are vying for market share, and Tesla seems uniquely suited to capitalize on this future growth. Tesla’s future revenues are derived from several sources:

- Tesla’s FSD subscription model: A subscription model will generate substantial recurring revenue. Tesla offers FSD as a one-time purchase, for $8000, or a monthly subscription for $99/mo, providing flexibility for consumers and a steady revenue stream for the company. There has been much speculation about the market penetration of FSD, with some sources reporting that only 2% of free trial users become subscribers. Currently, what percentage of Tesla’s fleet will employ FSD is pure speculation.

- Licensing Opportunities: Tesla’s software is powerful, and the potential for licensing its FSD technology to other automakers is a distinct possibility. This would diversify Tesla’s revenue and cement its position as a leader in the AV space. However, other entrants could challenge Tesla’s position, but the company clearly has the first mover advantage.

- Robotaxi Network: Elon Musk has often highlighted the potential for Tesla’s fleet to operate as a network of autonomous taxis. This concept, if realized, could revolutionize the transportation industry and create a highly lucrative business model for Tesla.

Tesla has built FSD from a vast collection of user data and advanced AI. As such, it will be extremely difficult for other companies to replicate. Significant hurdles, including regulatory approval, remain major challenges for the company. However, Tesla has been proactive in working with regulators and demonstrating the safety of its system. It must be noted that FSD still requires constant monitoring by a human driver. While public perception is shifting in favor of autonomous driving, it may be years before FSD lives up to its namesake.

Financial Impact on Tesla’s Stock

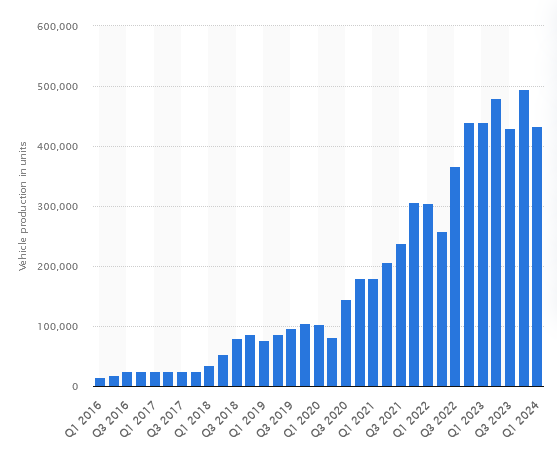

Obviously, the financial implications for full market penetration of FSD would be enormous for Tesla. Tesla has sold over 4.97 million vehicles to date and posted 1.81 million deliveries for 2023. While growth has slowed markedly, the long-term trend of EV sales has been impressive.

Number of Tesla Vehicles Produced Worldwide per Quarter (2016 through Q1 2024) (www.statista.com)

Imagine how even a low 2% market penetration rate would still represent approximately 99,400 vehicles across Tesla’s fleet. At $99/mo, this would represent approximately $118 million in annual additional earnings. Of course, this amount is relatively paltry compared to Tesla’s 2023 annual net income of $14.99 billion, but as adoption of FSD increases over time, the technology could become highly material to the stock.

This is a technology in its infancy, however, if adoption of FSD becomes increasingly prevalent in the coming years Tesla will be a major beneficiary of this long-term trend. Clearly, Tesla has the most advanced capabilities in this arena and is uniquely suited to capitalize on this growing market.

Conclusion:

The opportunity to test drive Tesla’s FSD was a remarkable experience. There is a feel to the technology not effectively captured from raw statistics that I would like to convey. I still remember the first time I opened a webpage back in the 1990s and the first time I used an iPhone in the 2000s. Both of those experiences felt different and new. They felt like the future was opening to an imaginary world that could be entirely different from the past.

Tesla’s FSD technology feels like something that is going to take the world by storm. Imagine a day when a car may not even require a steering wheel, where one simply lounges in the back seat after telling the car where to travel. That future suddenly feels much closer, and it is one that will be exciting for drivers and I believe lucrative for shareholders of Tesla.