Apu Gomes/Getty Images News

Introduction

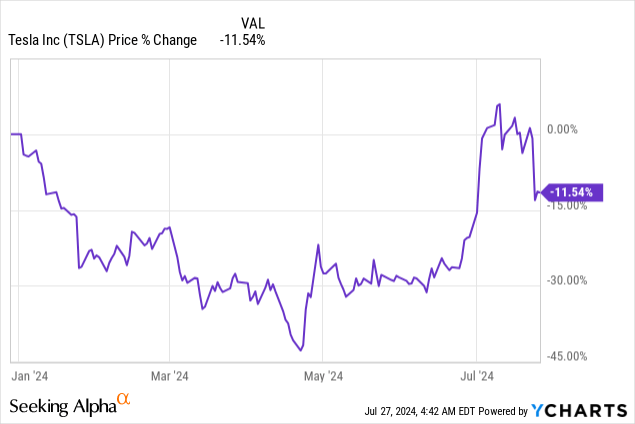

As it has always been with Tesla, Inc. (NASDAQ:TSLA), the stock has had a volatile quarter, swinging nearly 100% from its bottom of $140 to its recent high of $270.

And recently, the company reported Q2 earnings that sent the stock diving 12% the following day, which is coincidentally how the stock has performed this year so far.

In my view, the pre-earnings rally was driven by management’s vision about the future of the company (as I’ve highlighted in my previous article) while the post-earnings selloff was probably due to the delay of that vision.

That being said, Tesla stock is still down nearly 50% from its all-time highs, so in this article, I will highlight some reasons why the stock may be a good buy at current levels.

Of course, I will also mention some reasons why investors might want to avoid the stock.

Reason #1: All Hail to the EV King

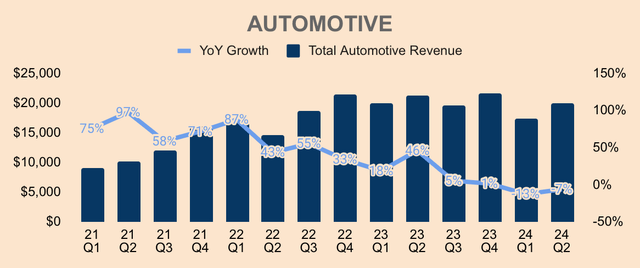

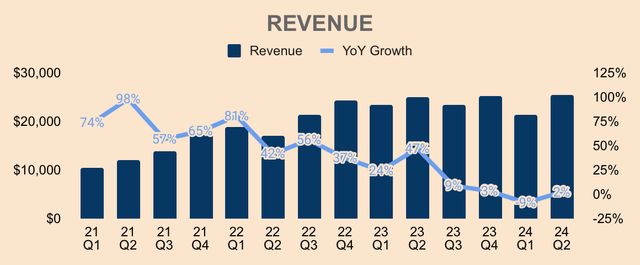

Looking at Tesla’s Q2 results, Tesla recorded $19.9B of Automotive Revenue, down 7% YoY, mainly due to lower average selling prices and a decline in vehicle deliveries. This is concerning as the Automotive unit makes up 78% of total Revenue. What’s more, peers such as Ford Motor Company (F) and General Motors Company (GM) actually grew in Q2.

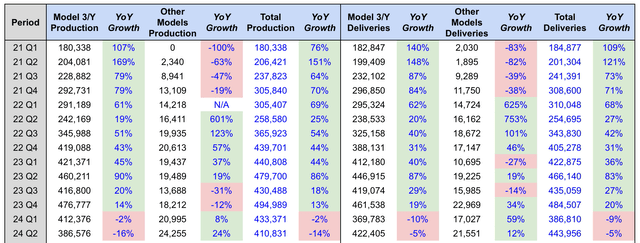

Let’s look at Tesla’s production and delivery numbers. We can see that Tesla produced 387K Model 3/Ys in Q2, down 16% YoY – I think management wanted to get their inventory in check given the tough macro environment currently. Production for other models was 24K, up 24% YoY, as Cybertruck production more than tripled sequentially. Altogether, Total Production was 411K in Q2, down 14% YoY.

In terms of deliveries, Tesla delivered 422K Model 3/Ys, down 5% YoY, even despite lower ASPs and attractive financing options. On the other hand, Tesla delivered 22K other models, up 12% YoY, likely driven by Cybertruck as it became the best-selling EV pickup in the US in Q2. But on aggregate, Total Deliveries were 444K, down 5% YoY.

Okay, not a good start at all, right?

But here’s why I think things will only get better from here:

- First, Q1 might be the trough. While Total Deliveries were down YoY, it actually increased QoQ, implying an improvement in overall consumer sentiment. Furthermore, management expects a sequential increase in production in Q3.

- Second, the Fed is expected to cut rates later this year, which could spark an influx of demand for Tesla vehicles – I think many consumers are waiting on the sidelines anticipating falling interest rates, which will improve overall affordability.

- Third, when we finally do get rate cuts, Tesla should be able to gradually increase ASPs as demand recovers, which should be a net positive for Revenue growth in future quarters.

Granted, we may not see strong results in Q3. However, beyond that, we should see a reacceleration in Tesla’s Automotive business.

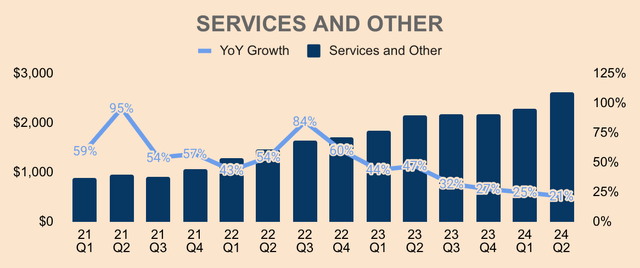

And despite the current challenges in the EV market, Services and Other Revenue maintained robust growth, up 21% YoY to $2.6B. Tesla continues to expand its Supercharging network and plans to deploy more capacity – more than the rest of the industry combined in the US – as well as onboard more OEMS throughout the year, which should “supercharge” growth in future years.

As you can see, the Tesla continues to expand its footprint in Q2:

- Tesla Locations were up 20% YoY.

- Mobile Service Fleet was up 7% YoY.

- Supercharger Stations were up 23% YoY.

- Supercharger Connectors were up 24% YoY.

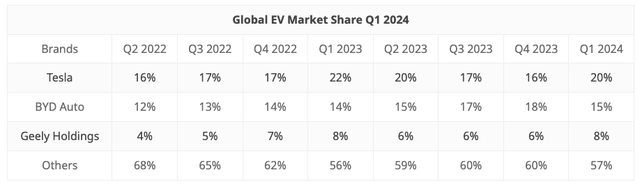

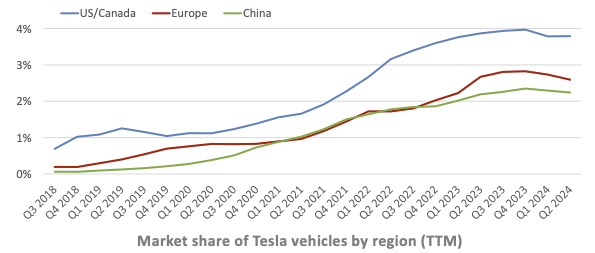

So while growth has been negative and market share has declined slightly, as seen in the chart below, Tesla has been busy expanding its ecosystem as it prepares for its next stage of growth.

Tesla FY2024 Q2 Quarterly Update Deck

Even so, Tesla still maintains the lion’s share of the EV market, with a global EV market share of 20% in Q1. In the US alone, Tesla has an EV market share of about 50%.

Sure, competition is catching up – that’s bound to happen as the EV market matures – and Tesla’s market share may continue to fall in the near term. However, being the industry leader in terms of performance, innovation, and ecosystem, I believe Tesla will remain the undisputed king of EVs for the next few decades or so.

Furthermore, with its strong brand moat, upcoming new product launches, unmatched ecosystem, looming rate cuts, and the world’s ongoing transition to full electrification, there’s little doubt that Tesla will return to growth mode. It should, therefore, expand its market share, thus solidifying its position as the EV king.

Reason #2: Energy Explosion

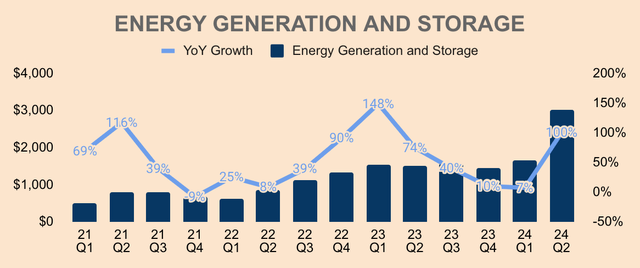

Perhaps, the biggest surprise of the quarter was the explosion in storage deployments, which was 9.4GWh, up a whopping 158% YoY. This is also more than double its previous record of 4.1GWh in Q1.

As a result, Energy Generation and Storage Revenue surged 100% YoY to just over $3.0B. This is a welcome reacceleration in the energy business after a few quarters of deceleration due to the slowdown in the solar unit.

I don’t think anyone saw this coming – and that’s one of the main reasons why the stock rallied before earnings.

Yes, this could be a one-off quarter where several large contracts were lumped in a single quarter – deployments in future quarters will likely fluctuate.

Regardless, it’s a testament to Tesla’s unique value proposition, disciplined execution, and unprecedented demand, even in an environment polluted by high inflation and interest rates.

Imagine how this business would do when the macro situation improves…

And as CEO Elon Musk mentioned, the energy business is more “demand constrained rather than production constrained,” and the company is working hard to ramp up production to meet the demand. For instance, the company is getting ready for the Shanghai Megafactory to start production in Q1 next year, which could double or even triple its output.

In addition, the CFO echoes Elon’s remarks, citing a strong deal pipeline and strong pricing power in the energy business (emphasis added).

So, I mean, we are working with a large set of players in the market and our pipeline is actually pretty long. And there’s actually very — there’s actually long end in terms of where you enter into a contract where delivery started — starts happening. And so far we have good pricing leverage.

(CFO Vaibhav Taneja – Tesla FY2024 Q2 Earnings Call).

It’s also worth mentioning that solar demand should pick up once again when the Fed cuts rates, and combined with the momentum in the storage business, we could see exponential growth in Tesla Energy in the years to come.

Reason #3: Solving Autonomy

As a whole, Tesla generated $25.5B of Revenue in Q2, up only 2% YoY. Despite the tiny YoY gain, this beat analyst estimates by $760M.

Nevertheless, the markets aren’t really concerned about Tesla’s near-term slowdown. They’re more interested in the long-term growth story of the company – more specifically, the narrative that Tesla will one day solve autonomy.

After all, the markets are forward-looking.

Having said that, Tesla is on the right track to achieving the impossible.

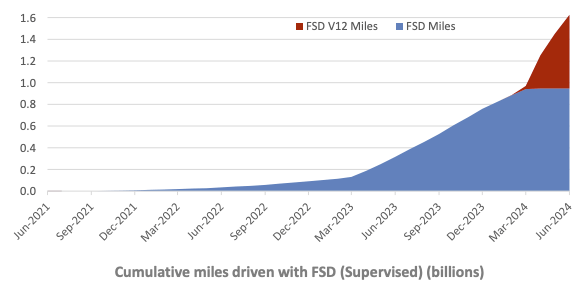

Valuable FSD data is flowing in at an exponential rate as more and more Tesla owners opt in for the FSD program following its price reduction. Tesla is also offering free trials to certain customers, which, frankly speaking, is a win-win for both parties – customers get to test FSD at no cost while Tesla gets to collect more data and higher FSD attach rates once the trial ends.

And as the fleet becomes smarter and as more users spread their experiences through word of mouth, expect “more meaningful FSD monetization,” which should boost Automotive Revenue. And let’s not forget, that Tesla also intends to license its FSD technology, which is yet another growth catalyst for Tesla.

Tesla FY2024 Q2 Quarterly Update Deck

Once unsupervised (important keyword here) FSD is fully rolled out, Tesla can begin deploying its robotaxi service, which is another long-term Revenue booster. Though it is disappointing that the robotaxi product unveil was delayed by a couple of months, it allows Tesla to further improve the product as well as “to show off a couple of other things.”

Whatever it is, the robotaxi product will be a key growth driver for Tesla given the massive potential of an unmanned, autonomous, transportation service. As mentioned by management (emphasis added), autonomy is “the biggest differentiator for Tesla” – and so far, only Tesla is bold enough to venture into this unchartered water.

The big — really by far the biggest differentiator for Tesla is autonomy. In addition to that, we’ve scale economies and we’re the most efficient electric vehicle producer in the world. So, this, anyway — while others are pursuing different parts of the AI robotic stack, we are pursuing all of them. This allows for better cost control, more scale, quicker time to market, and a superior product, applying not to — not just to autonomous vehicles, but to autonomous humanoid robots like Optimus.

(CEO Elon Musk – Tesla FY2024 Q2 Earnings Call).

Speaking of Optimus, management also mentioned that the humanoid robot has begun performing tasks in one of Tesla’s factories, and is expected to have several thousands of them by the end of 2025. By 2026, Optimus should be available to outside customers.

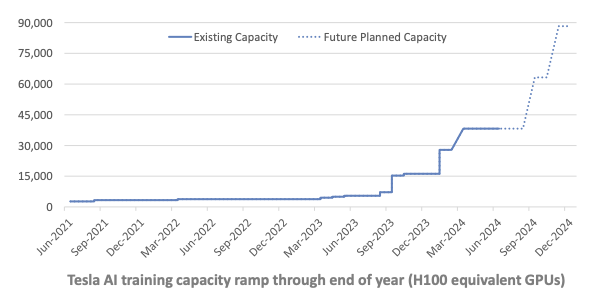

All these projects require heavy AI training and compute. That is why Tesla is investing heavily in its software infrastructure. For one, the company is still working on its supercomputer, Dojo – to hedge against NVIDIA GPU shortages as well as to build an in-house computer that will make Tesla even more vertically integrated.

In addition, Tesla also plans to invest $5B into Elon’s AI startup, xAI, which could speed up Tesla’s AI developments and capabilities.

Whatever it is, solving autonomy is Tesla’s next grand mission, which could drive monumental Revenue and earnings growth for decades to come. With all its current investments and developments, Tesla seems to be on the right trajectory and is likely to be the first (and perhaps, only) company to solve full-scale autonomy.

Tesla FY2024 Q2 Quarterly Update Deck

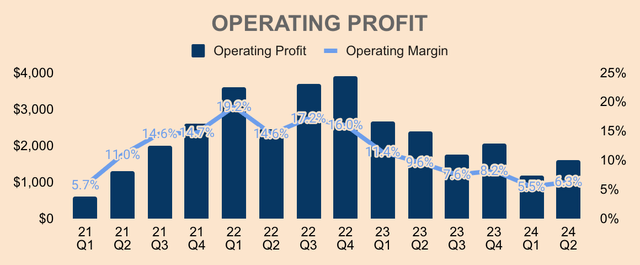

Reason #4: Margins Might Have Bottomed

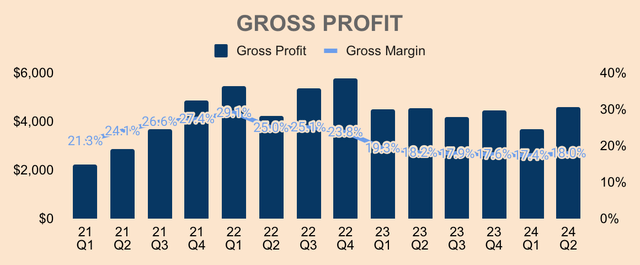

In Q2, Tesla produced $4.6B of Gross Profit at an 18.0% Gross Margin, which is down 20bps YoY. However, the Gross Margin expanded 60bps QoQ, signifying a possible reversal after a 2-year downtrend.

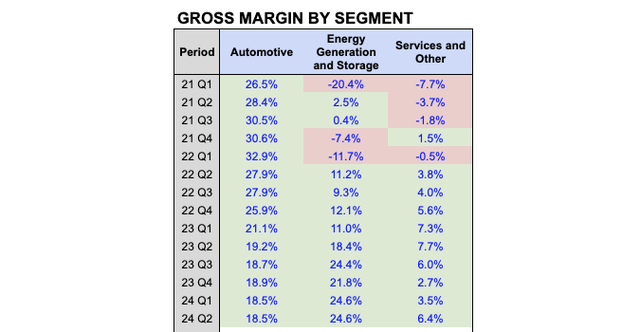

As expected, Gross Margin expanded sequentially due to the outgrowth of Tesla’s non-automotive business. As you can see, Tesla Energy has the highest Gross Margin of 24.6% as of Q2 – its rapid growth relative to the Automotive division means that it will be margin accretive to the entire business. Furthermore, Services and Other Gross Margin also improved sequentially.

As always, the real debate revolves around Tesla’s Automotive Gross Margin, which was down 70bps YoY. While margins were flat QoQ, keep in mind that it was largely due to record Regulatory Credit Revenue. Excluding Regulatory Credit Revenue, the Q2 Automotive Gross Margin would have been 14.6%, down from 18.1% last year and 16.4% a quarter ago. Automotive Gross Margin was also negatively affected by the Cybertruck ramp and lower ASPs.

Yes, not a good look at all.

However, there are reasons to believe that Automotive Gross Margin might improve from here:

- Tesla is ramping up production for its in-house 4680 battery, up 50%+ QoQ, and is testing it with its Cybertrucks. Once fully ramped, we should see cost per vehicle drop meaningfully, thus boosting margins.

- Again, when the Fed cuts rates, I believe Tesla will gradually increase ASPs, leading to a higher margin per vehicle.

- Per the CFO, cost per vehicle excluding the impact of Cybertruck actually dropped QoQ, so once the Cybertruck fully ramps, we should see margins improve as well. Management expects the Cybertruck operation to be profitable by the end of the year.

That being said, Q2 Operating Profit was $1.6B at a 6.3% Operating Margin, which improved 80bps QoQ. This included $622M of restructuring charges, so without this one-time charge, the Operating Profit would have been $2.2B and the Operating Margin would have been 8.7%. This is a sign that margins might have bottomed.

Besides, Tesla is still investing for the future (Reason #3) so margins are expected to be volatile. In addition, Tesla is sacrificing margins today – as seen with lower ASPs, competitive financing options, and new product launches – in an attempt to gain as much market share as possible.

One day, when Tesla is ready to deploy its high-margin products… margins will take off.

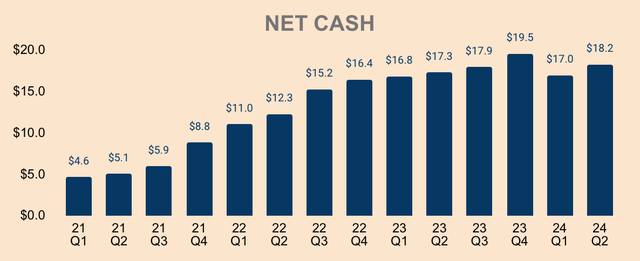

Reason #5: $30B Cash Hoard

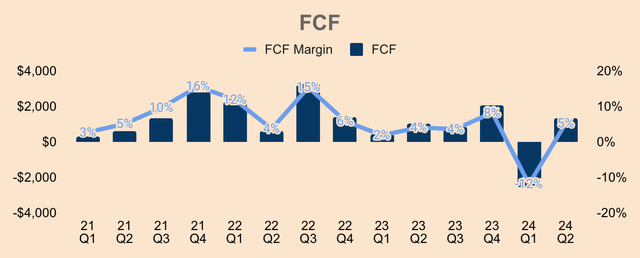

Meanwhile, Tesla maintains a strong balance sheet with $30.7B of Cash and Short-term Investments and Total Debt of $12.5B. All in all, Tesla has $18.2B of Net Cash, which increased by $1.2B QoQ.

The increase was driven by a positive Free Cash Flow of $1.3B, representing a 5% FCF Margin, which is a much-needed improvement QoQ, primarily due to a drop in inventory levels.

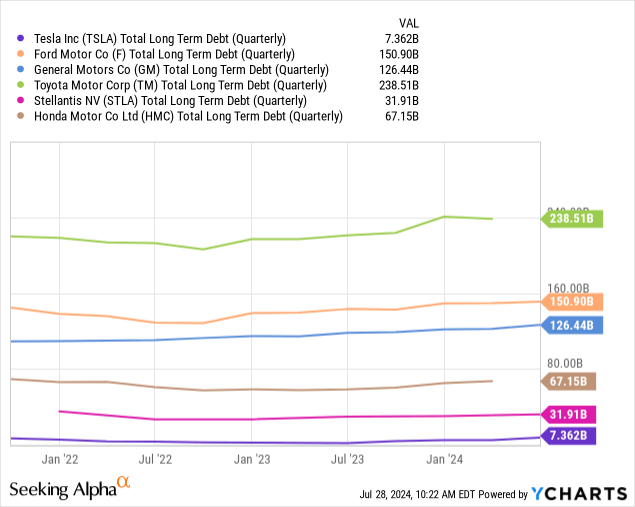

But here’s the chart that sets Tesla apart from legacy automakers. As you can see, Tesla has just $7.4B of Long-term Debt while peers have way more debt on their balance sheet, which creates an immense level of inertia for them. As for Tesla, its low debt and positive Net Cash position provides it with great financial flexibility and the privilege to invest in other future projects, while competitors have to deal with their high debt obligations first.

This is why Tesla has such a strong cost advantage over its peers.

Reason #6: Fair Valuation

Valuation is subjective – especially in the case of Tesla stock.

You have bears saying it’ll go to $26. You have bulls saying it’ll go to $2,600. The valuation spectrum for Tesla stock is expansive.

So I’ll keep this section short.

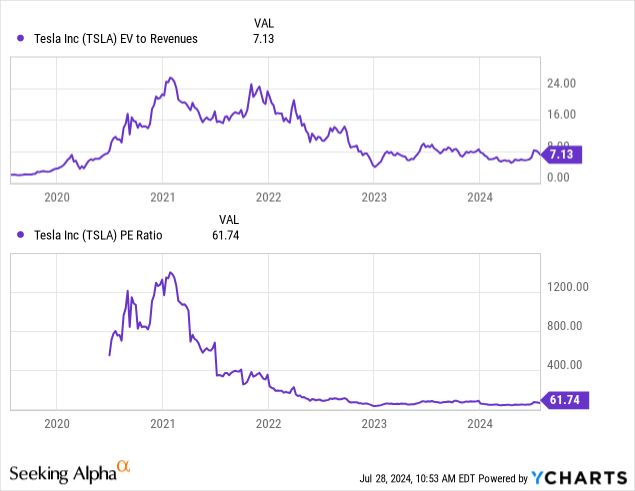

As it stands, Tesla trades at an EV-to-Revenue multiple of 7.1x and a P/E ratio of 61.7x. Now, these multiples are not cheap by any means, but given historical standards, Tesla looks pretty attractive here.

And given Tesla’s strong brand, cost advantages, and efficient scale moats, as well as long-term growth potential in EVs, renewable energy, and autonomy, I believe Tesla’s premium valuation is justified.

However, investors will need to have the stomach to endure the volatility – I think Tesla’s premium valuation is mostly tied to its moonshot projects, namely FSD, robotaxi, Optimus, and so on.

I think it will take some time, probably a few more years or so of iteration before Tesla’s moonshot projects begin to materialize and commercialize, and therefore, contribute to the company’s top line.

Even so, its bottom line might remain under pressure for an additional year or so, as it would require these projects to reach a certain scale before they positively impact the company’s bottom line.

Until then, Tesla’s P/E ratio might remain elevated, probably for the next five years or so, which means Tesla stock will be prone to any negative news like launch delays or regulatory setbacks.

For now, I think Tesla stock trades at a reasonable valuation – right at fair value.

That being said, there are a lot of near-term catalysts that make Tesla stock a compelling buy, including interest rate cuts, the robotaxi event in October, as well as FSD approval.

However, there are downside risks as well…

Risks (aka Reasons to Sell)

- Margin compression: I argued that margins might have bottomed in Q1 – keyword might. If Tesla’s profit margins continue to fall further, the stock will likely follow suit.

- Execution: management’s goals and targets might also be overly optimistic. Even Elon himself admitted to this. That said, the production ramp may be slower than anticipated. New product launches may get delayed. Promises may turn out to be empty. These will negatively impact the stock in the short term.

- Regulatory approvals: FSD, robotaxis, Optimus, AI… these are nascent categories. The regulatory watchdogs will be watching Tesla very closely. Any opposition would be a major blow to Tesla’s business.

- If you don’t believe Tesla will solve autonomy: I’ll let Elon explain.

The value of Tesla overwhelmingly is autonomy. These other things are in the noise relative to autonomy. So I recommend anyone who doesn’t believe that Tesla will solve vehicle autonomy should not hold Tesla stock. They should sell their Tesla stock. You should believe Tesla will solve autonomy, you should buy Tesla stock. And all these other questions are in the noise.

(CEO Elon Musk – Tesla FY2024 Q2 Earnings Call).

- Elon Musk: Recently, Elon said that two people have already tried to assassinate him in the past eight months. That’s unfortunate and disgraceful. That said, the success of the company is heavily reliant on its current CEO, it seems. What if Elon is not with us anymore? What happens to Tesla? This is a major risk to consider.

Thesis

Following its Q2 earnings release, Tesla stock sold off 12%, and as it stands, the stock is still down 45% from its all-time highs. Perhaps, it might be a good time to buy the stock – in this article, I highlighted six reasons why that is so:

- Tesla is the king of EVs – and it will continue to be the case in the upcoming decades.

- Energy is taking off – Revenue and profit generation from the segment will be margin accretive.

- Tesla is probably the only company that has a chance of solving vehicle autonomy.

- Margins might have bottomed – further sequential improvement will excite investors.

- Tesla is in the best financial position in its history, with $30B of cash in hand.

- The stock is fairly valued (in my opinion).

Of course, there are risks. But with a top-quality, durable company like Tesla, I think it’s reasonable to assume that Tesla will do well in the coming years.